What I’m Reading

The Hangover: California has a near-$100 billion budget surplus thanks to booming asset prices leading to a capital gains windfall. As usual, politicians in Sacramento are fighting over how to spend the money quickly by establishing new social programs or funding large one-time expenditures. However, with asset values – particularly tech stocks – crashing, the state would be far better served to save that windfall for the inevitable deficit that is inevitable with our highly unstable tax base. Cal Matters

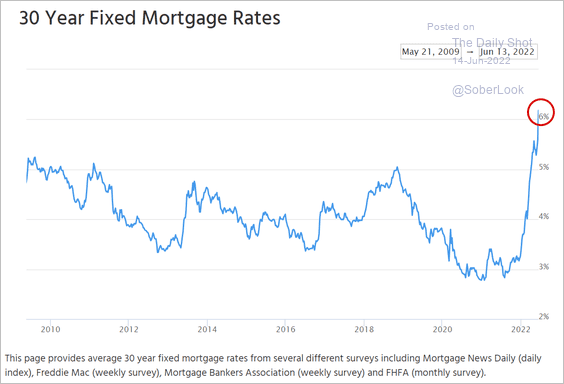

Nudge: The massive rise in the monthly cost of home ownership is going to continue to push more people towards rentals. JBREC

Coming Home: The trend of US companies re-shoring supply chains should provide a tailwind to well-positioned industrial developers. Fortune

Feedback Loop: The push to return to the office is not going well as employees continue to push for remote work options. In addition, even those employees who wanted to return are finding a less dynamic and collaborative environment when their colleagues only come in three days a week. Of course, less people means less services and less collaboration, forming a negative feedback loop that will be challenging to overcome unless everyone comes back full time. Vox

First Movers: Private investor are buying up shopping centers and other brick and mortar retail property – and finding attractive deals after years of weak growth – even as REITs and other big players remain cautious. Wall Street Journal

Chart of the Day

The magnitude and velocity of this move puts us well into uncharted territory.

Source: The Daily Shot

WTF

Escape: A man facing fraud charges was arrested trying to flee to Cuba on a jet ski because Florida. Tampa Bay Times

Sign of the Times: Two men are wanted for allegedly stealing 1,100 gallons of diesel fuel after tampering with pumps because Florida. Fox 35

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com