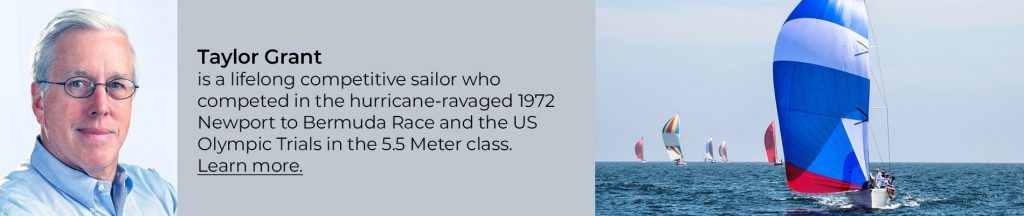

The name RanchHarbor is derived from the unique experiences of our company’s founders.

“A smooth sea never made a skilled sailor.”

–– Franklin D. Roosevelt

In 2020, the founders and key professionals from Isles Ranch Partners and Landmark Real Estate joined forces to create RanchHarbor.

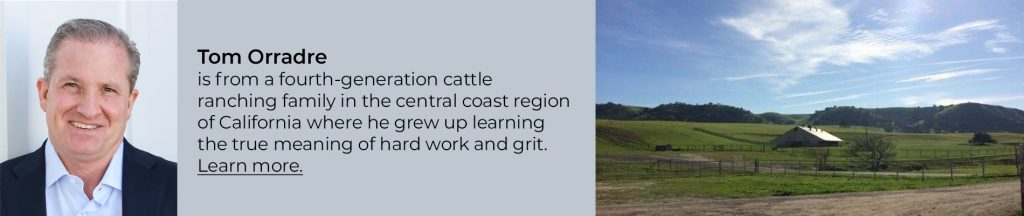

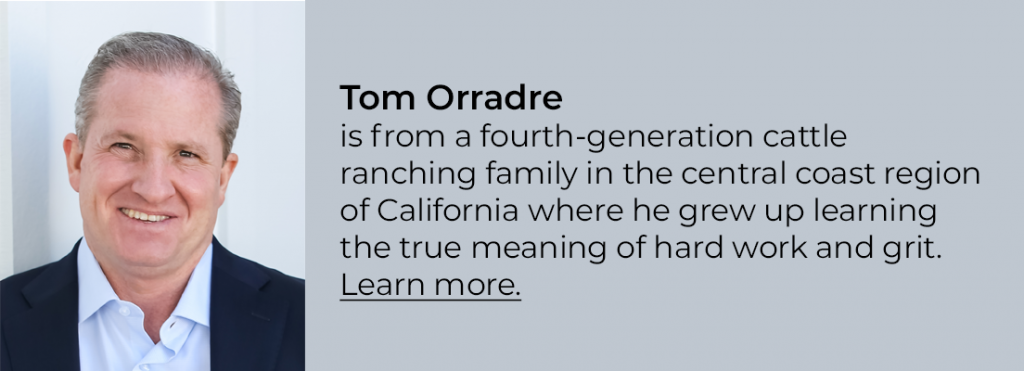

Isles Ranch Partners is a real estate investment and asset management firm founded by Tom Orradre in 2012. Isles Ranch has invested over $620 million of equity capital in distressed residential land development and homebuilding projects through a strategic partnership with a global private investment firm. Total revenue generated from the portfolio to date exceeds $1.7 billion.

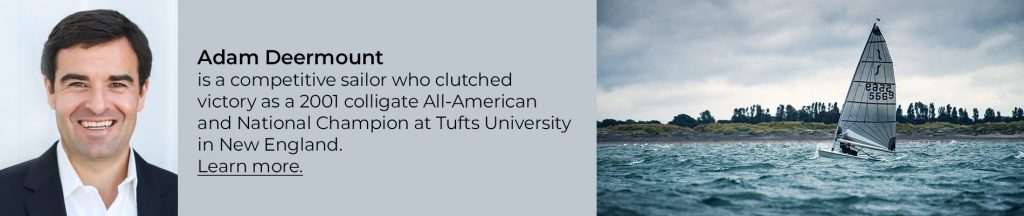

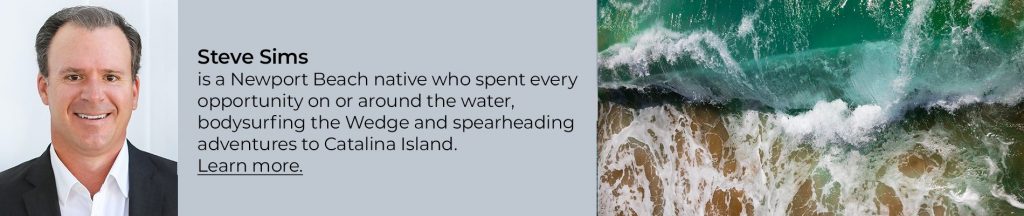

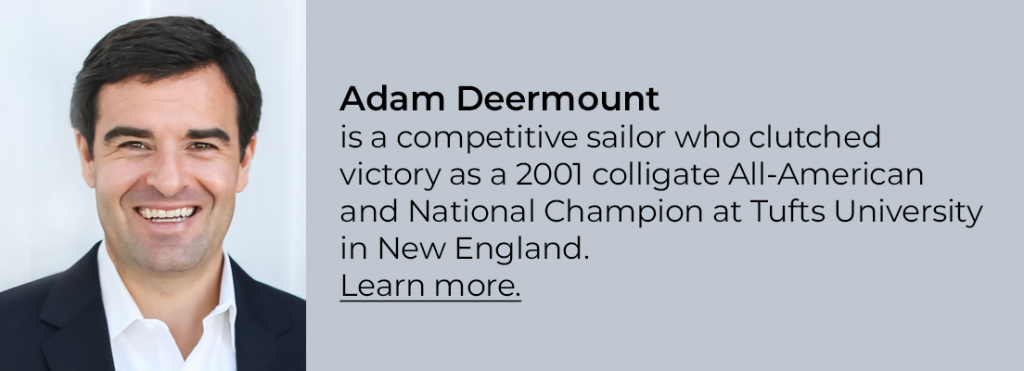

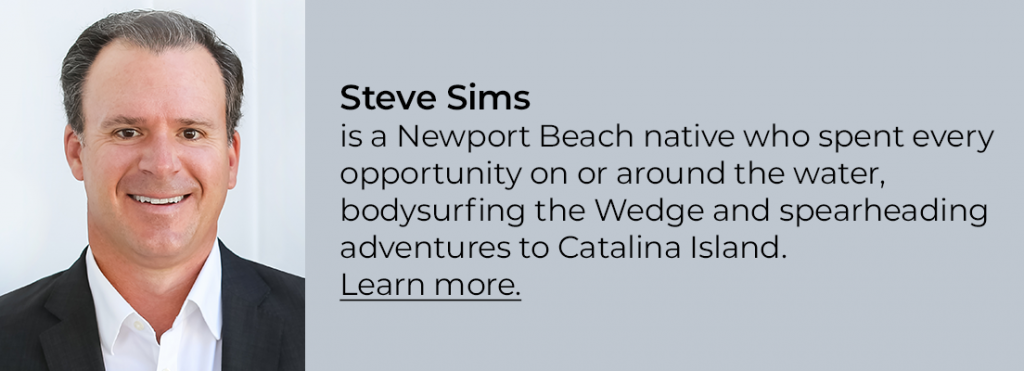

Landmark Real Estate is a commercial and residential real estate capital advisory firm co-founded by Adam Deermount and Steve Sims. Leveraging expertise and experience in complex transactions and troubled assets, Landmark was established to help investors and sponsors secure financing for their real estate projects.

Meet the team