Investments

Explore Our Portfolio of Investments

We actively pursue value-add, yield-oriented investment opportunities in the multifamily, industrial and storage sectors. We employ a ‘total return’ investment objective – seeking income generation and strong capital appreciation over the investment horizon.

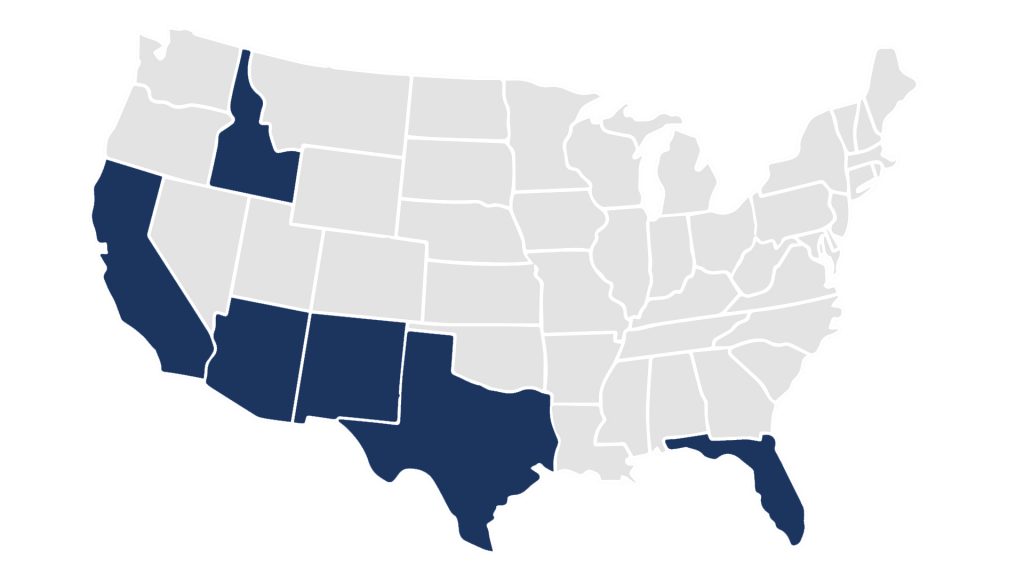

Boise, ID

Austin, TX

Albuquerque, NM

Signal Hill, CA

San Dimas, CA

San Marcos & Poway, CA

Phoenix, AZ

Altamonte Springs, FL