What I’m Reading

Scaling Back: Higher prices for personal- and home-care items are driving Americans to purchase fewer consumer staples as inflation crimps budgets. Bloomberg

Hitting the Brakes: Multifamily lending is expected to slow down for the remainder of 2022 as higher rates take a toll. However, the MBA is still forecasting a rebound in 2023. Globe Street

Myth Busters: Prologis’ CEO Hamid Moghadam told investors that they haven’t seen any signs of leasing weakness despite rumors about Amazon putting 10-30m sf of unused warehouse space on the market for sublease. Sourcing Journal

800 LB Gorilla: Blackstone is in the final stages of raising a new real-estate fund that would set a record as the biggest vehicle of its kind, defying market volatility and a crowded landscape for fundraising. The new fund is expected to total $30.3 billion, roughly 50% larger than its predecessor, a $20.5 billion pool raised in 2019. The Wall Street Journal

Turning Point: The California Public Employees’ Retirement System (CalPERS) saw a negative return of 6.1% on its investments for the fiscal year ended June 2022, its first losing year since 2009. Stock holdings, which make up 79% of the portfolio were down big, offset by strong performance in Private Equity. (h/t Randy Coe) Sacramento Business Journal Given that this is CalPERS, expect a big rotation into PE just as it hits a downward inflection point and stocks rip.

Chart of the Day

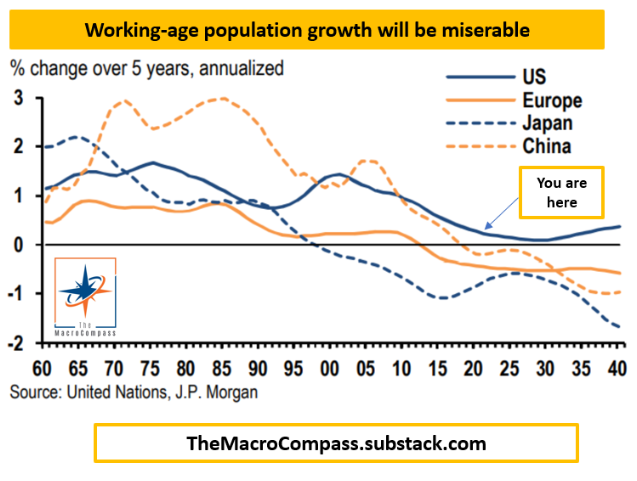

When it comes to developed world demographics, the US is the best house in a really bad neighborhood.

Source: The Macro Compass

WTF

I Thought This Was America? A woman brandishing a pitchfork and whip was arrested for trying to sell teddy bears outside a grocery store because Florida. Also because drugs. Fox 35

Exact Change Only: A man threatened to shoot up and burn down a Subway when told he needed to pay for his footlong sandwich with cash because Florida. Tampa Free Press

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com