What I’m Reading

Flipped: Renters are now the majority in 103 suburbs that were previously homeowner territory 10 years ago, and 57 other suburbs are expected to follow suit in the next five years. Many of these suburbs belong to the Miami, Washington, D.C., and Los Angeles metros. RentCafe This trend likely picks up steam as homeownership becomes more expensive in highly desirable suburbs. IMO, these are also likely the places most at risk of having rent control implemented as the composition of voters shifts from owners to renters.

Down for the Count: Leisure travel has experienced a strong bounce back year in 2021. However, business travel is still struggling. Corporate, group, government, and other commercial travel – are expected to be down by $59 billion in 2021 from 2019, according to a report from the American Hotel and Lodging Association (AHLA) and Kalibri Labs. That equates to a whopping 80% decline for the 20 largest destinations in the US. AHLA The longer this continues, the harder it will be for it to return to normal.

Boom Town: Its no secret that the Phoenix market is booming. Most of the attention there seems to be focused on the white hot apartment segment. But the industrial market is on fire as well and spec development is booming as developers are getting more aggressive to meet tenant demand. AZ Big Media

Conspicuous Consumption: Consumers are spending more as they shop. In each of the 12 months since March 2020, the average amount spent per shopping occasion has been between 13% and 29% higher than the same month in the prior year, according to a survey by the NPD Group. Those new spending levels have held relatively steady since March 2021.Part of this has to do with a generational shift towards ecommerce – where goods tend to be more slightly more expensive. So far, the COVID increased consumption trend seems to be sticking. Globe Street

Contagion? China Evergrande Group, the second largest developer in the country will miss debt payments this month and is at serious risk of default. With $305 billion in liabilities, this has the potential to be a Lehman Brothers-style collapse that could have broad implications for the global financial system. Evergrande is trying to sell assets but so far, investors are holding back and waiting for more distress. While Evergrande is the highest profile case at the moment, other large Chinese developers are struggling to access liquidity as well. Reuters

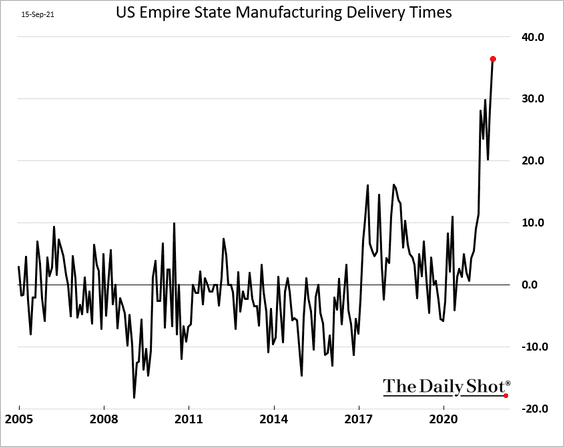

Chart of the Day

The supply chain problems are getting worse.

Source: The Daily Shot

WTF

Overkill: Runners in the upcoming San Francisco marathon will have to wear masks on some portions of the course in order to comply with health protocols because California. KCBS Radio

Rest Up: A 61 year old Indiana man was arrested after repeatedly calling 911 to report that he was tired. Good news is he’ll have plenty of time to rest up in jail. The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com