What I’m Reading

Stretching Out: Multifamily investors are increasingly stretching their holding timeframes – sometimes by 2-3x. This is being driven by both a dearth of product coming to market that makes redeployment of capital difficult and a desire to obtain fixed rate debt with inflation surging. WealthManagement.com

Bubbling Over: A number of trends — in public health, American demographics and venture capital funding — are colliding to supercharge the life sciences industry, sending demand for laboratory space through the roof. Axios

Ghost Ships: Ships in Chinese waters are disappearing from industry tracking systems, creating yet another headache for the global supply chain. China’s growing isolation from the rest of the world — along with a deepening mistrust of foreign influence and a new Chinese data protection law — may be to blame. CNN

Taking the Under: Good profile in the WSJ on investors who are betting on the decline of the office sector via shorting selected REITs and mortgage bond pools. Wall Street Journal

Level Up: The pace of multi-story warehouse development is picking up in large, dense and expensive markets. The trend will likely continue so long as land prices continue to inflate. Globe Street

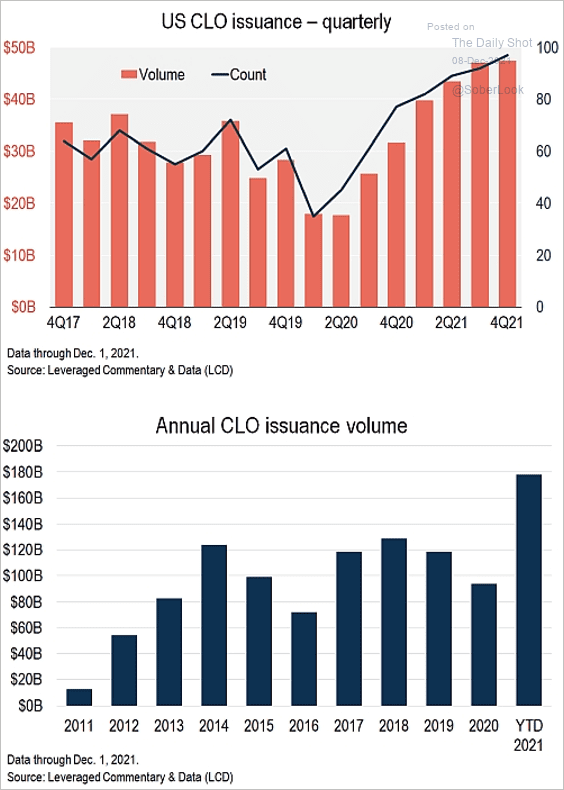

Chart of the Day

The LIBOR deadline generated a surge in CLO issuance going into the year-end.

Source: The Daily Shot

WTF

Nip and Tuck: More than 40 camels were booted from a beauty pageant where breeders compete for $66MM in prize money after the animals were administered Botox, hormones and other appearance enhancing techniques because Saudi Arabia. NY Post

Munchies: A Massachusetts cannabis company baked the world’s largest pot brownie – weighing 850 lbs – to honor National Brownie Day. Oregon Live

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com