Tactical asset management that empowers and guides stakeholders through complex transactions, development hurdles and financial restructurings.

Through our proactive approach, RanchHarbor serves asset owners, lenders and operating partners with strategic planning discipline and guidance to achieve asset optimization.

Focused objective: To extract maximum value from the asset.

Equipping stakeholders with powerful tools for success.

Asset Transparency

RanchHarbor’s independent assessment and management provides unbiased, objective analysis of an asset and its potential, and helps to identify challenges.

Boots-on-the-ground Insight

“In-the-trenches” asset management approach enables stakeholders to seize opportunity and quickly adjust strategy.

Decision-Making

Transparent, accurate and in-depth asset/portfolio analysis provides a clear path for smart decision-making and improves overall decision quality.

Focused Oversight

Full attention to the asset throughout the investment lifecycle equips stakeholders with the highest level of detail activity and performance.

Active Asset Management

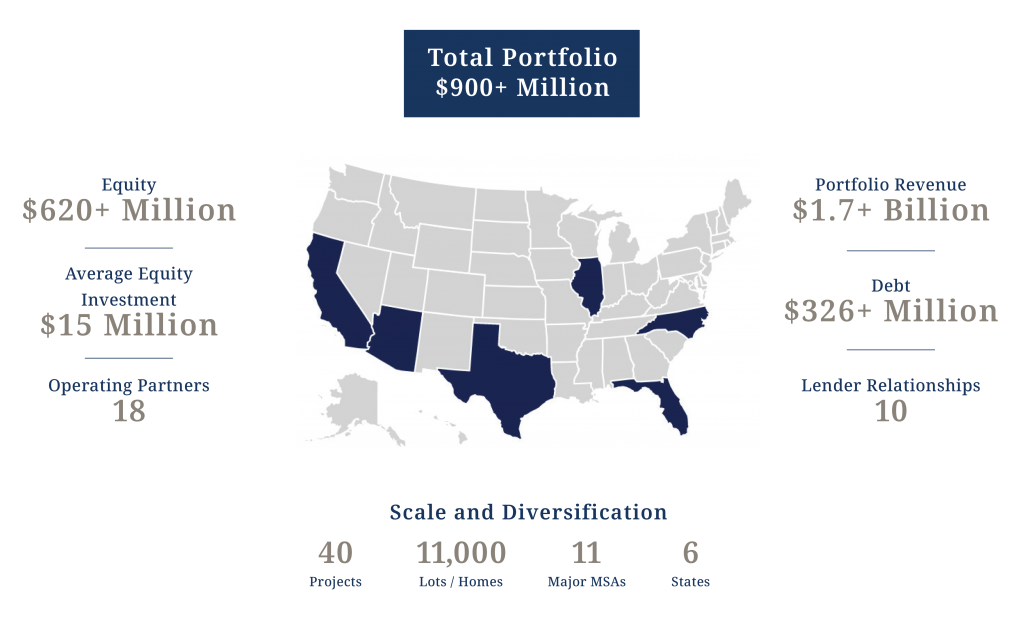

RanchHarbor’s asset management team (formerly Isles Ranch Partners) is actively managing a large portfolio of residential A, D and C equity investments on behalf of a global private investment firm with $16 billion in assets under management. Currently, over 75% of the investments have been realized. Information below represents the total portfolio.

Equity

$620+ Million

Average Equity Investment

$15 Million

Operating Partners

18

Portfolio Revenue

$1.7+ Billion

Debt

$326+ Million

Lender Relationships

10

Scale and

Diversification

40

Projects

11,000

Lots / Homes

11

Major MSAs

6

States

Disciplined asset

management and value

optimization through

every stage.

- Due Diligence and Asset Valuation

- Business Plan Execution

- Asset Disposition

- Institutional-Quality Accounting

and Reporting

Disciplined asset management and

value optimization through every stage.