What I'm Reading Guessing Game: Pandemic uncertainty has made it extremely difficult for appraisers to assign values to office buildings. IMO, this will continue until the dust clears and the impact on demand from work from home can be fully quantified. Globe Street Windfall: Crypto whales are cashing out some...

January 31st – Breaking Point

What I'm Reading Coming Up Short: Two years after Apple, Google, and Meta vowed to spend $4.5 billion to create more than 40,000 new homes in their home state of California, they’ve accomplished a fraction of that goal. The Real Deal Turns out that all the cash in the world...

January 28th – The Great American Camp Out

What I'm Reading The Great American Camp Out: Results for the RV Industry Association’s December 2021 survey of manufacturers determined that total RV shipments for 2021 ended with a record 600,240 wholesale shipments, surpassing the 2017 total of 504,599 shipments by 19%. Total RV shipments for 2021 increased 39.5% over...

January 27th – Risky Business

What I'm Reading Risky Business: With interest rates rising, and property prices at all time highs, Canadian homeowners are increasingly turning to variable rate mortgages as a lower cost alternative. Variable rate mortgages, which offer a substantially lower initial payment now make up over half of all new home loans...

January 26th – Blood in the Water

What I'm Reading Material Shortfall: Dealers in John Burns’ building products survey appear to be planning and buying inventory based on an inaccurate expectation of growth in 2022. If the results of the survey turn out to be accurate, materials companies are underestimating demand, which will cause more shortages and...

January 25th – Up and To The Right

What I'm Reading Up And To The Right: Average monthly listed rents in the US increased 14.1% year over year, according to a report issued by real estate brokerage firm Redfin. Meanwhile, the national monthly mortgage payment for homebuyers climbed 21.6% year over year, also the biggest increase in Redfin’s...

January 24th – On the Clock

What I'm Reading On the Clock: The 2017 tax law contains a provision allowing for bonus depreciation on eligible assets, allowing investors who qualify as a real estate professional to shelter income, even in the absence of a 1031 exchange. A sunset provision was built into the law, meaning that...

January 20th – Getting High on Your Own Supply

Chart of the Day A bit of a narrative violation from RealPage's Jay Parsons challenging the assumption that supply constrained markets tend to outperform when it comes to rental growth. Supply, in and of itself isn't a bad thing. In fact it adds to economic growth creating jobs for new...

January 19th – In Limbo

What I'm Reading Not Out of the Woods: Trepp's overall CMBS delinquency rate increased for the first time in 18 months. The move was driven by issues in the office sector which is still facing work from home headwinds. Over the next five years, 42% of the full-term interest-only loans for office...

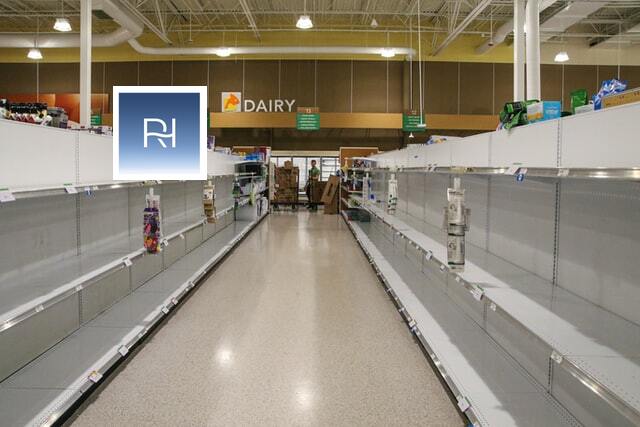

January 18th – Bare Shelves

What I'm Reading Bare Shelves: US home sales fell the most in 18 months in December. A lack of supply, not demand is driving the move. As would be expected in this environment, prices are still increasing rapidly. Bloomberg Coming Around: As the pandemic wears on, corporate America is increasingly...