What I’m Reading

Wild West: The non-fungible token (NFT) trend is coming to commercial real estate as platforms look to tokenize assets via blockchain technology in order to provide more flexibility to investors.

This segment of the market is fascinating to me but there a ton of potential major pitfalls. For example, what sort of control provisions do tokenized owners have if the GP/Sponsor fails to perform the business plan, defaults on the mortgage, etc? These are individual buildings, not a REIT or other public company with a board of directors and an organized management structure. All that being said, if the governance portion is addressed adequately, it could be a really interesting way to address liquidity in the secondary market. Caveat Emptor, I guess. Commercial Observer

Inverse: From supply to pricing to demographics, when it comes to the housing market in the US, the post-pandemic environment is the exact opposite of 2008 in nearly every way possible. Epsilon Theory

All Inclusive: Office landlords are adding tenant perks and amenities ranging from on-site child care to dry-cleaning pickup, manicures and grocery delivery in an effort to lure workers back. In other words, the cost to keep offices occupied is going through the roof as demand is falling. Seems like a great business model. New York Times

Kicking the Can: Lender patience with regards to forbearance has been remarkable this cycle as the reckoning that many of us predicted last spring has yet to materialize. My take: not much is really going to happen until a couple of quarters or after we fully open up again. At that point, it will become obvious which properties were simply pandemic impaired and which have long term operating issues in the post pandemic world. Financial Times

Winners and Losers: Moody’s analysis shows subtle discounts for retail and hotel but limited evidence of stress for all other sectors. In multifamily and industrial, cap rates fell and price per unit increased a bit. IMO, it is perfectly logical that this would happen. Interest rates are still low (on a historical basis versus cap rates) and multi-family and industrial are performing well for the most part (except for high priced gateway apartment markets). At the same time, office, retail and hotel are nearly un-investible for many large funds and that must-place capital has to go somewhere so it ends up in the two sectors that are still performing well. Globe Street

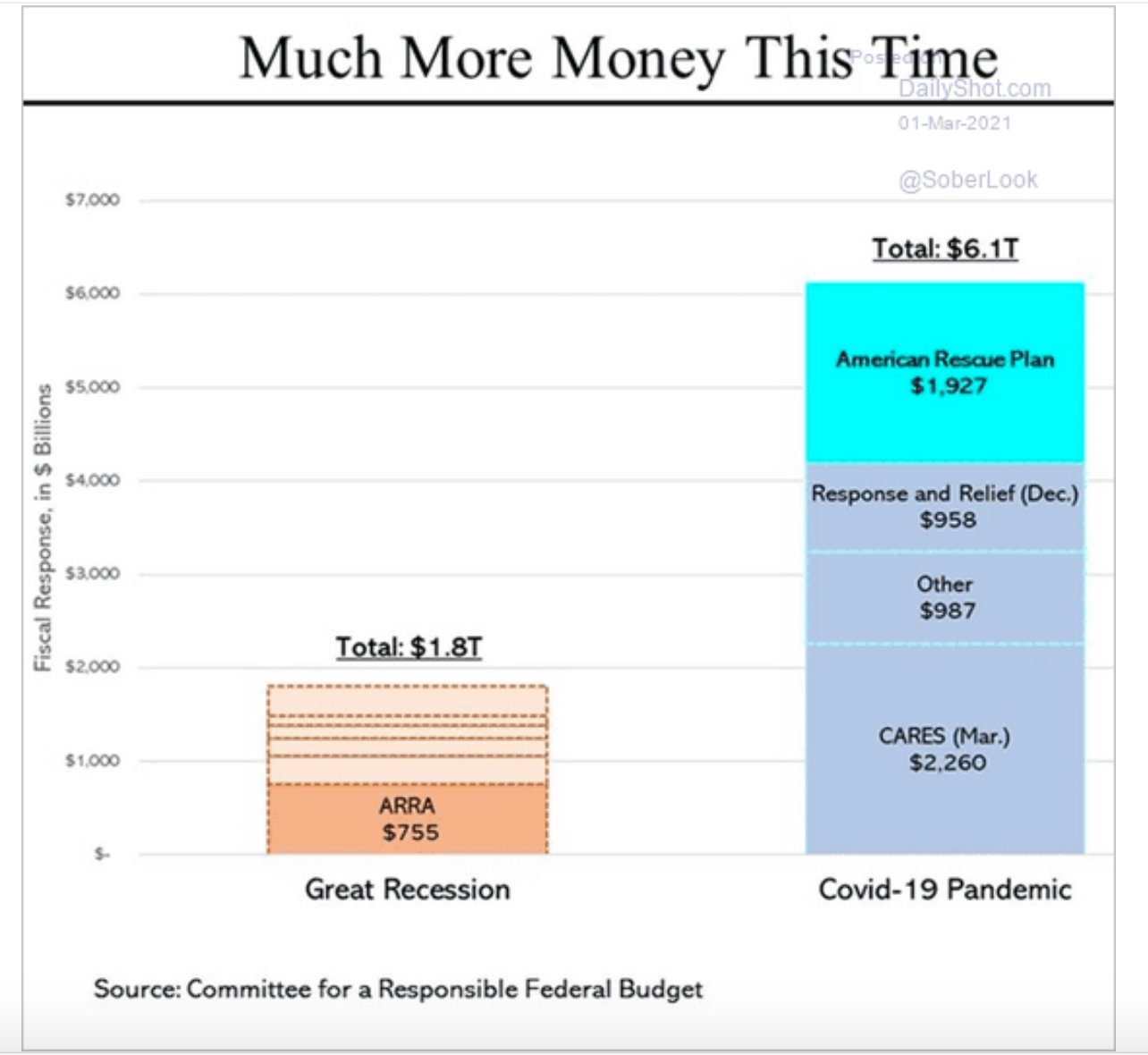

Chart of the Day

Source: Adam Tooze

WTF

Bend Over: China has made its anal swab COVID test mandatory for all foreign visitors. This makes sense because there is no better way to get back in the good graces of the international community after setting off a global pandemic than to forcibly stick objects up their asses in order to enter your country (h/t Michael Deermount). Reuters

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com