What I’m Reading

No Slack: Nearly every economic issue that we are currently experiencing is a result of the lack of slack in our system being a feature and not a bug. David Merkel sums the conundrum up perfectly:

There’s not enough slack in the system. We need more redundancy. And that won’t happen because firms are looking to maximize the return on equity, and as such they tend not to keep too much excess supply of ability to produce or transport. Most government regulation does not help here, but it would be interesting to see what would happen if the government mandated that firms maintain sufficient slack capacity for production or transport. That would be an ugly regulation, but if it affected everyone maybe it wouldn’t be so bad. How to enforce that would be an absolute headache and so it will never happen.

Frenzy: The real estate boom is overwhelming small towns that are now being targeted by deep pocket investors and primary home buyers. Many of these markets were attainable for middle class buyers just a year ago but are now out of reach. Wall Street Journal

Hedging Bets: Nearly three-quarters of real estate industry professionals believe that office leasing velocity in major cities will return to pre-pandemic levels within the next four years, according to a new survey by law firm Morrison & Foerster. However, when asked which markets are currently best suited for commercial real estate acquisitions, however, just 47 percent of respondents ranked primary markets as one of their top choices.

A whopping 21% of respondents thought that office leasing velocity in major markets will never return to pre-pandemic levels. The Real Deal

Big Split: CRE performance metrics will likely continue to improve this year, though analysts caution the recovery will remain bifurcated. Research from Moody’s Analytics shows that while industrial will remain steady and multifamily family rents and vacancies will turn around in the short term, the future of office, retail, and some hotel subtypes is uncertain. Globe Street

Rise of the Machines: The United States today is producing roughly the same amount of goods and services as before the coronavirus pandemic — but with 8.2 million fewer workers. The lasting macro impact of COVID 19 may turn out to be rising productivity thanks to acceleration of the introduction of industrial robots, advanced software and artificial intelligence that reduced their dependence upon workers. The societal implications here are obviously massive and the acceleration will continue to heat up as labor shortages and wage pressures persist. Washington Post

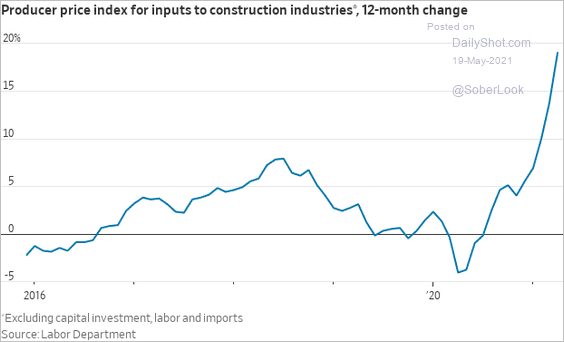

Chart of the Day

No surprise here. Construction costs are going parabolic, meaning that prices and rents must rise for development to pencil. Who ultimately benefits from this? Owners of existing properties.

Source: The Daily Shot

WTF

Giving Away the Farm: WeWork’s $21. billion loss in the 1st Quarter included a $500MM settlement paid to disgraced founder Adam Neumann and $299MM of impairments due to early termination of leases, among other things. Bisnow

Custody Battle: A family dispute over custody of a pet turtle in Ohio required police intervention. The Smoking Gun

Basis Points – A candid look at the economy, real estate, and other things sometimes related. Visit us at RanchHarbor.com