What I’m Reading

Aaaaand Scene: The cameras are rolling and Hollywood’s film industry is slowly coming back to work, That is bringing intense demand for studio space, new interest from investors and higher rental rates. Commercial Observer

Losing Hope: As the pandemic recession continues, many small and midsize U.S. banks find themselves buried under a pile of potentially troubled commercial real-estate loans. LA-based Bank of Hope’s loan portfolio may be one of the most vulnerable. It had $3.1 billion in loans with Covid-19-related payment deferrals or other modifications as of June 30, according to its second-quarter earnings call. That accounts for around 18% of the bank’s total assets, ranking among the highest percentage for these kinds of loans in the country. Personal note – these guys were incredibly aggressive getting money out the door over the past few years. I refinanced my mortgage with them back in 2017 with a 2.75% rate at a time when the 10-year treasury was yielding 2.4%. Granted, it was lower leverage but I could never figure out how the math worked on that one. Turns out it didn’t and I haven’t been able to find a better deal on a jumbo loan refinance even with the 10-year yield below 0.7% Wall Street Journal

Out of Balance: A massive surge of import demand in the US and Europe has resulted in a container shortage in Asia. JOC.com

Rolling Inventory: Mobile home parks have been a notably strong performer during the pandemic and Blackstone is backing up the truck to buy them up. The alternative asset manager is in exclusive talks to acquire roughly 40 parks – mostly located in Florida – from Summit Communities for about $550 million. Bloomberg

Common Ground: Multi-family landlords and tenants are often at odds these days with unemployment leading to missed rent payments and ultimately an inability to pay mortgage bills. However, there is one thing that they both agree on: the industry needs federal rental assistance in order to prevent a catastrophe. Bisnow

Over the Coals: ProPublica is out with an absolutely damning indictment on California’s fire management: ProPublica

The pattern is a form of insanity: We keep doing overzealous fire suppression across California landscapes where the fire poses little risk to people and structures. As a result, wildland fuels keep building up. At the same time, the climate grows hotter and drier. Then, boom: the inevitable. The wind blows down a power line, or lightning strikes dry grass, and an inferno ensues. This week we’ve seen both the second- and third-largest fires in California history. “The fire community, the progressives, are almost in a state of panic,” Ingalsbee said. There’s only one solution, the one we know yet still avoid. “We need to get good fire on the ground and whittle down some of that fuel load.”

Chart of the Day

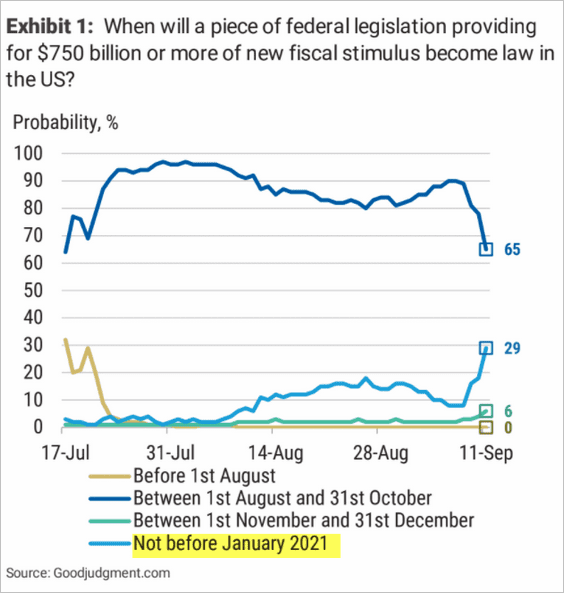

Forecasters are increasingly doubtful about another US stimulus package this year.

Source: Morgan Stanley via @soberlook

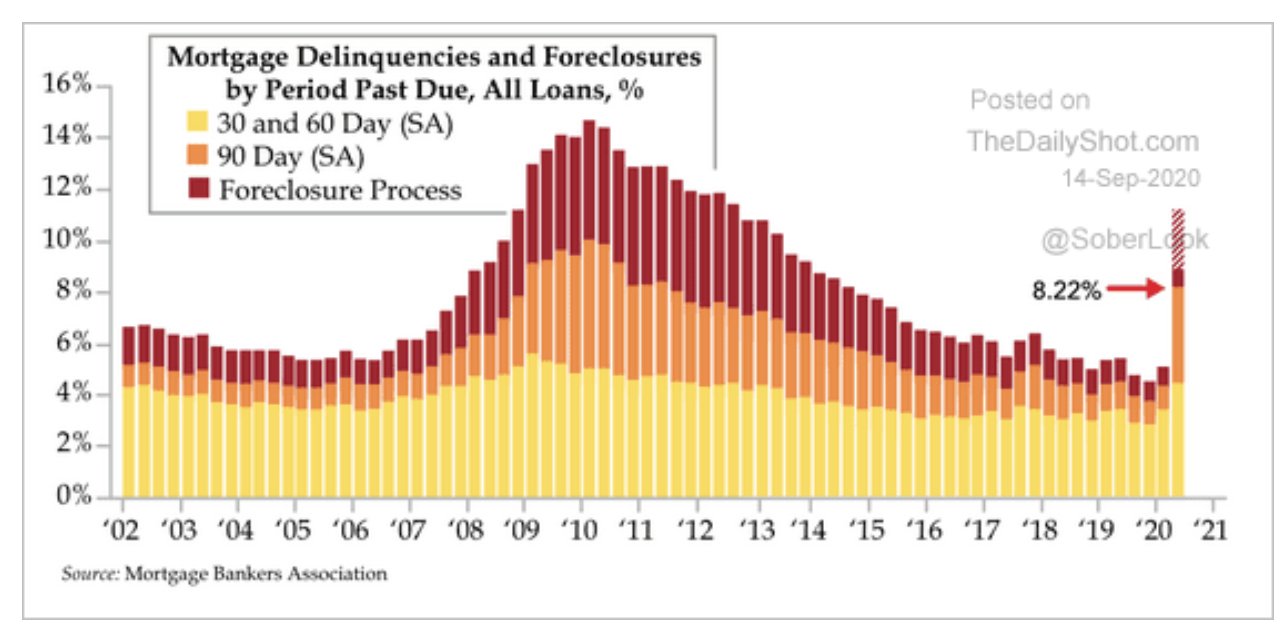

Closely related: Millions of homeowners in USA are falling behind with mortgage payments.

Source: Quilll Intelligence via @SoberLook

WTF

Rebel Without a Clue: A man was removed from Disney’s Hollywood Studio for refusing to wear a mask while shouting misquotes from Disney’s A Bug’s Life because Florida. WDW News

Hard Evidence: The new National Geographic special “Bin Laden’s Hard Drive” analyzes the porn collection found in the slain terrorist’s compound—and presents a theory that the terrorist leader was sending coded messages in porn. The Daily Beast

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com