One Big Thing I’ve been hearing a lot of chatter about the future of cities of late, especially those of the large gateway variety that boomed in the years following the Great Recession. The latest example is a Globe Street piece last week that excerpted a CBRE podcast about the future of...

December 7th – Behind the Curve

What I’m Reading Behind the Curve: As expected, eCommerce orders surged to previously unseen levels this Black Friday and Cyber Monday. It got to the point that UPS put limits on pickups at several large retailers in an effort to not overwhelm their systems, despite knowing that this was coming. Wall Street...

December 4th – Strings Attached

What I’m Reading Strings Attached: CMBS borrowers that were granted initial forbearance in Q2 2020 are requesting another round of debt relief from servicers. However, even if granted this relief is likely to come with more stringent parameters such as additional equity contributions and personal recourse. Those who refuse or don’t...

December 3rd – Emptied Out

What I’m Reading Emptied Out: In 2011, US department stores employed 1.2 million employees across 8,600 stores, according to estimates from the research firm IBISWorld. But in 2020, there are now fewer than 700,000 employees in the sector, working across just over 6,000 locations. Vox Comeback Kid: The fact that AirBnb is about...

December 1st – Bargain Bin

What I’m Reading Bargain Bin: Cross border transactions are way down this year. However, the US commercial real estate market is starting to look very cheap to foreign investors, who find their currency hedging costs – driven by interest rate differentials between two currencies – aligning nicely with the direction of...

November 30th – Steady and Slow

What I’m Reading Slow and Steady: While the CMBS issuance volume has been consistently inching upward, 2020 issuance will close at roughly half of what was predicted a year ago, according to Kroll Bond Rating Agency. Kroll estimates this year’s total CMBS issuance will be $55 million while $95 billion was...

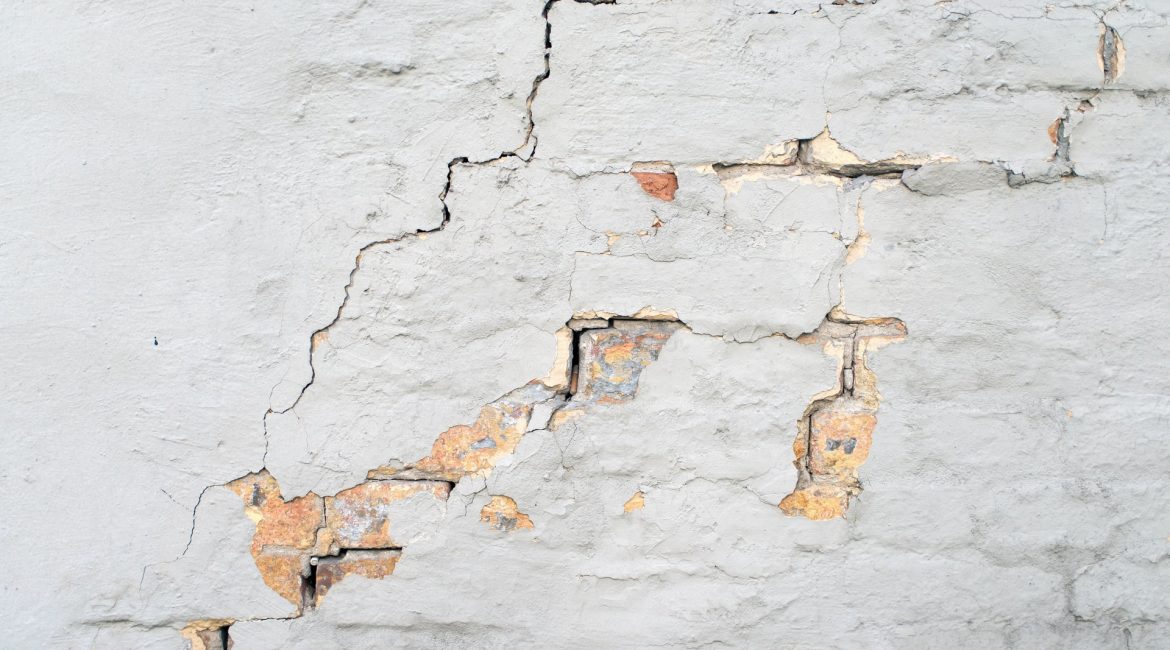

November 24th – Cracks in the Armor

What I’m Reading Cracks in the Armor: Chuck E Cheese (CEC Entertainment) was able to successfully use a Force Majeure clause to lower its rent in a bankruptcy case. This provided evidence that bankruptcy courts may be willing to grant debtors extraordinary relief in light of the ongoing pandemic, but...

November 23rd – Its Going Down

What I’m Reading Its Going Down: The MBA is out with its 2021 market outlook for housing. The big news here is that they are projecting a major slowdown for the mortgage lending industry with refinances falling a whopping $1 trillion – from $1.97 trillion to $971 billion – thanks to...

November 20th – Swept Under the Rug

What I’m Reading Swept Under the Rug: October marked the fourth straight month that the overall lodging delinquency rate has fallen, according to Trepp. Unfortunately, this isn’t due to improved property performance but rather granted forbearance that is allowing loans to “current” status. Globe Street See Also: A new survey of American Hotel &...

November 19th – Ringing the Bell

One Big Thing The Fed is now in a tricky spot when it comes to their massive mortgage bond buying program (emphasis mine): All of this serves to squeeze mortgage-bond investors in higher-rate securities. Most of them bought the debt at a premium, and the constant reduction in lending rates leaves...