What I'm Reading On Demand: Pop-up distribution centers are becoming a thing as the pandemic forced retailers and e-commerce platforms to quickly and cost-effectively respond to localized demand surges in their supply chains. Chain Store Age Cream Rises to the Top: For years, international investors favored office buildings when it...

April 29th – Liftoff

What I'm Reading Liftoff: Apartment List's national rent survey for May showed its largest monthly jump going back to 2017 as coastal markets rebound and midsized markets that soared in 2020 show few signs of slowing down. This further backs up the story we posted yesterday about OAR picking up. ...

April 2nd – Go Time

What I'm Reading Go Time: Majority Leader Chuck Schumer is pushing the Senate toward lifting the federal prohibition on marijuana with legislation that would represent the biggest overhaul of federal drug policy in decades. The plan goes beyond decriminalization and is expected to remove marijuana from the list of controlled...

February 23rd – Showing My Age

One Big Thing One of my blogging topics is narrative violation. A narrative violation what happens when a piece of data runs counter to a popular story or trend. The classic example of this was the whole “millennials never want to own homes or cars” thing that was making the...

February 19th – Narrative Violation

What I'm Reading Narrative Violation: For almost a year now, there has been a popular media and financial industry narrative that people are leaving San Francisco in droves and pouring into Austin and Miami. However, a new report from the postal service based on change of address (COA) requests found...

January 7th – Reading the Tea Leaves

One Big Thing Now that the elections have come finally, mercifully come to a close, I thought that it would be a good idea to take a look at the likely winners and losers both in the real estate sector and the economy as a whole. I’m going to do...

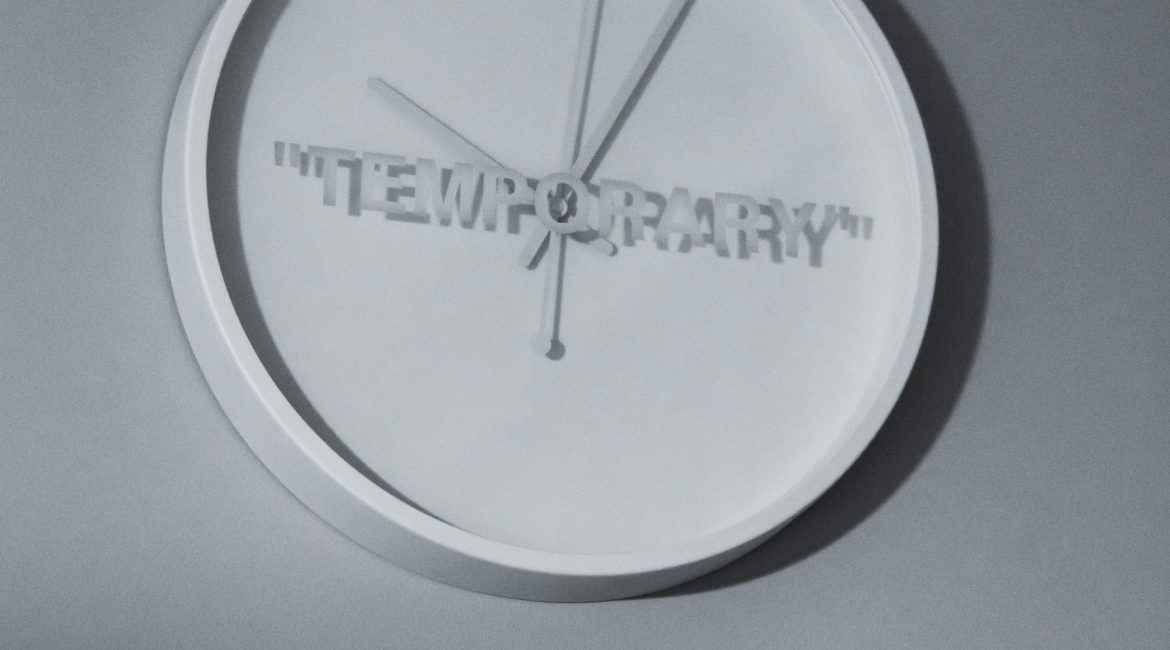

December 21st – Temporary Move?

What I’m Reading Temporary Solution: The number of renters seeking short term (less than 6 month) lease arrangements when moving to new cities is way up this year. This suggests that the move away from urban markets may be more temporary than thought. Apartment List Sweet Spot: Pent up demand, healthy...

December 14th – Unlocked

What I’m Reading Unlocked: Increased adoption of remote work has enabled high earners to move to lower tax states like never before. At some point high tax cities and states are going to have to acknowledge that the conditions that allowed them to increase rates – namely the requirement of proximity...

November 30th – Steady and Slow

What I’m Reading Slow and Steady: While the CMBS issuance volume has been consistently inching upward, 2020 issuance will close at roughly half of what was predicted a year ago, according to Kroll Bond Rating Agency. Kroll estimates this year’s total CMBS issuance will be $55 million while $95 billion was...

November 23rd – Its Going Down

What I’m Reading Its Going Down: The MBA is out with its 2021 market outlook for housing. The big news here is that they are projecting a major slowdown for the mortgage lending industry with refinances falling a whopping $1 trillion – from $1.97 trillion to $971 billion – thanks to...