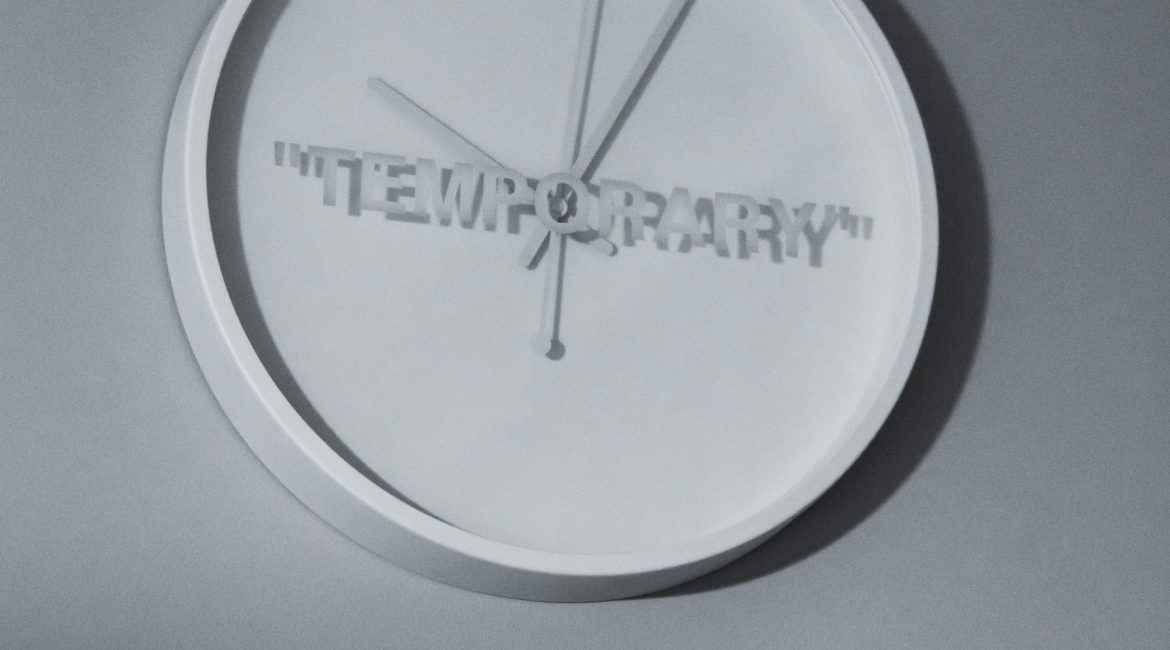

What I’m Reading Temporary Solution: The number of renters seeking short term (less than 6 month) lease arrangements when moving to new cities is way up this year. This suggests that the move away from urban markets may be more temporary than thought. Apartment List Sweet Spot: Pent up demand, healthy...

December 16th – Cracking the Code

Cracking the Code: Dr. Peter Linneman of Linneman Associates and Matt Larriva, vice president of research and data analytics at Chevy Chase, Md., property firm FCP, believe they have devised a methodology that accurately forecasts acquisition yields up to a year into the future. The model is based on the unemployment...

December 15th – Checked Out

What I’m Reading Checked Out: Buyers are spending more time than ever in their vacation homes. Mansion Global See Also: A new homes.com survey found that 45% of respondents would move if they could work remotely. Forbes Soaring: Home equity reached a record high in 2020 as American homeowners gained a whopping $1 trillion. Core Logic See...

December 14th – Unlocked

What I’m Reading Unlocked: Increased adoption of remote work has enabled high earners to move to lower tax states like never before. At some point high tax cities and states are going to have to acknowledge that the conditions that allowed them to increase rates – namely the requirement of proximity...

December 11th – Staying Power

What I’m Reading Staying Power: Office CMBS distress may last quite a bit longer than initially thought according to Trepp as revenues continue to decline while expenses rise. Globe Street See Also: As employers eagerly await the Covid-19 vaccines that promise to return staff to offices after months of working from home, new...

December 9th – Balancing Act

One Big Thing California’s eviction moratorium is scheduled to expire in early February. A new assembly bill is seeking to extend it through the end of 2021. Concurrently another assembly bill is attempting to establish a framework for dispersing rental relief. (h/t Steve Sims) Connect Media Two comments here: While I’m...

December 4th – Strings Attached

What I’m Reading Strings Attached: CMBS borrowers that were granted initial forbearance in Q2 2020 are requesting another round of debt relief from servicers. However, even if granted this relief is likely to come with more stringent parameters such as additional equity contributions and personal recourse. Those who refuse or don’t...

December 2nd – The End is in Sight

What I’m Reading The End is in Sight: The Federal Reserve has told banks that they should stop writing contracts using LIBOR by the end of 2021, after which the rate no longer will be published. The current plan is that LIBOR will be fully phased out by June 30, 2023. ...

November 25th – Locked Down

What I’m Reading Locked Down: In a move that should come as no surprise, President Elect Joe Biden and his team are leaning towards extending the CDC eviction moratorium that is set to expire December 31st. Ultimately, this program is just a band aid that forces landlords to shoulder the burden...

November 23rd – Its Going Down

What I’m Reading Its Going Down: The MBA is out with its 2021 market outlook for housing. The big news here is that they are projecting a major slowdown for the mortgage lending industry with refinances falling a whopping $1 trillion – from $1.97 trillion to $971 billion – thanks to...