What I'm Reading Whack a Mole: Americans moved around a lot over the past two years, and those destinations also now happen to have the highest inflation rates in the U.S per new research from Redfin. Conversely, places like San Francisco that people left tend to have lower inflation. Redfin...

May 20th – Holding the Bag

What I'm Reading Holding the Bag: The Federal Reserve now owns $2.72 trillion in mortgage backed securities, up from $1.4 trillion in 2020. It has announced the intent to shrink that amount substantially in order to help tighten monetary policy. However, most of those loans are at much lower rates...

June 1st – Taking Aim

What I'm Reading Don't Call it a Comeback: 2021 has been a banner year for apartment rent growth thus far with rents nationwide rents now surpassing where they would have been had the pandemic never happened. ApartmentList Inside Deal: Real-estate agents are selling more homes to select customers while bypassing...

January 6th – No Going Back

What I’m Reading No Going Back: The pandemic has has accelerated the adoption of data access as an essential CRE technology. At this point, it is no longer just a pandemic solution and is here to stay. Globe Street Priced Out: Despite record low mortgage rates, the spike in housing prices last year...

January 4th – Blurred Lines

What I’m Reading Blurred Lines: States are facing off in a high-stakes legal battle over who is entitled to income taxes on remote workers when one is employed by a company in one state but resides in another. The results of this high-stakes legal battle will have a profound impact on...

December 16th – Cracking the Code

Cracking the Code: Dr. Peter Linneman of Linneman Associates and Matt Larriva, vice president of research and data analytics at Chevy Chase, Md., property firm FCP, believe they have devised a methodology that accurately forecasts acquisition yields up to a year into the future. The model is based on the unemployment...

December 15th – Checked Out

What I’m Reading Checked Out: Buyers are spending more time than ever in their vacation homes. Mansion Global See Also: A new homes.com survey found that 45% of respondents would move if they could work remotely. Forbes Soaring: Home equity reached a record high in 2020 as American homeowners gained a whopping $1 trillion. Core Logic See...

December 14th – Unlocked

What I’m Reading Unlocked: Increased adoption of remote work has enabled high earners to move to lower tax states like never before. At some point high tax cities and states are going to have to acknowledge that the conditions that allowed them to increase rates – namely the requirement of proximity...

December 8th – Spin Cycle

One Big Thing I’ve been hearing a lot of chatter about the future of cities of late, especially those of the large gateway variety that boomed in the years following the Great Recession. The latest example is a Globe Street piece last week that excerpted a CBRE podcast about the future of...

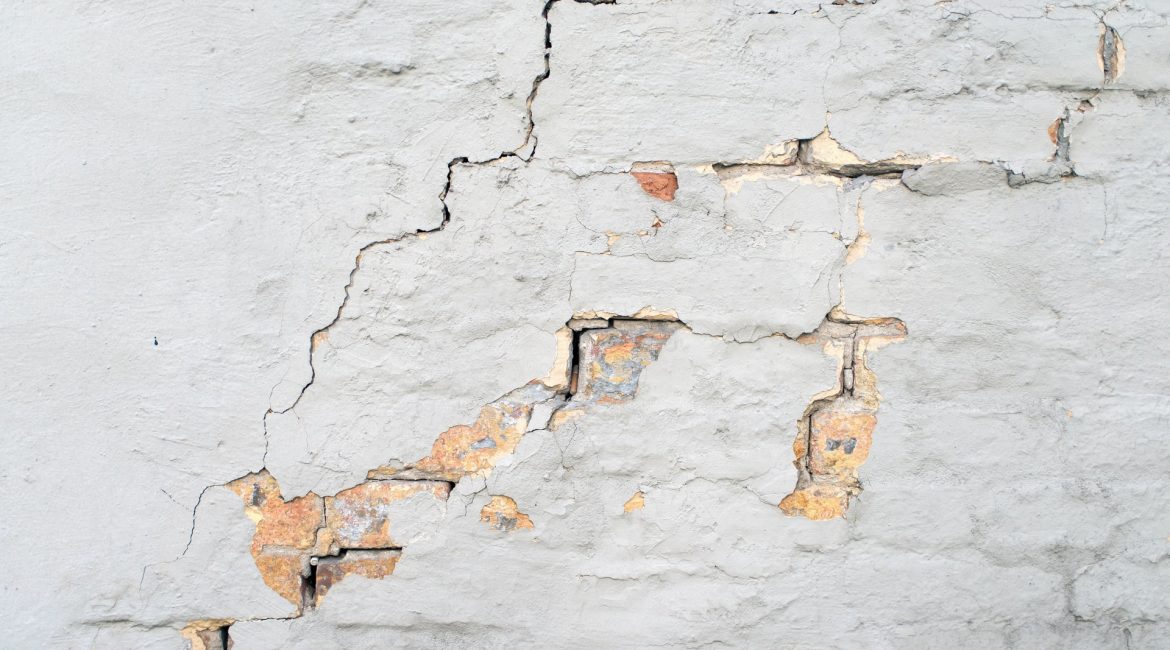

November 24th – Cracks in the Armor

What I’m Reading Cracks in the Armor: Chuck E Cheese (CEC Entertainment) was able to successfully use a Force Majeure clause to lower its rent in a bankruptcy case. This provided evidence that bankruptcy courts may be willing to grant debtors extraordinary relief in light of the ongoing pandemic, but...