What I'm Reading Fuel on the Fire: Every $1 billion in additional e-commerce sales requires 1 million square feet of new warehouse space to support it. Using this calculation as a baseline, the US will need 330 million square feet of new space by 2025 just to keep up with...

January 4th – Blurred Lines

What I’m Reading Blurred Lines: States are facing off in a high-stakes legal battle over who is entitled to income taxes on remote workers when one is employed by a company in one state but resides in another. The results of this high-stakes legal battle will have a profound impact on...

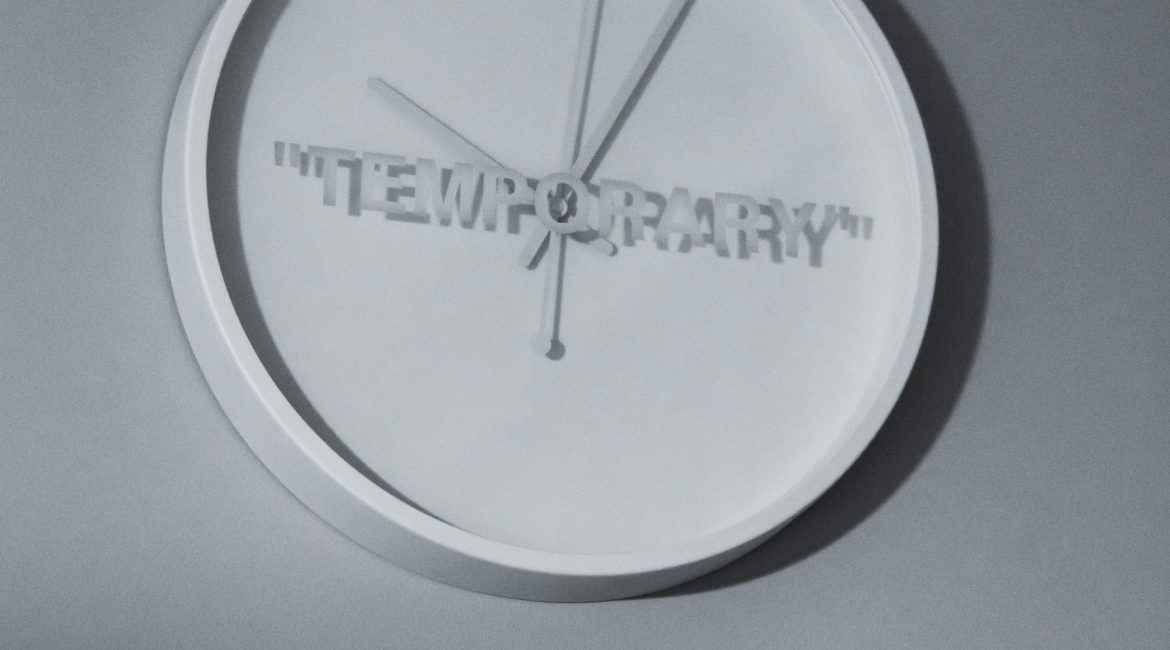

December 21st – Temporary Move?

What I’m Reading Temporary Solution: The number of renters seeking short term (less than 6 month) lease arrangements when moving to new cities is way up this year. This suggests that the move away from urban markets may be more temporary than thought. Apartment List Sweet Spot: Pent up demand, healthy...

December 11th – Staying Power

What I’m Reading Staying Power: Office CMBS distress may last quite a bit longer than initially thought according to Trepp as revenues continue to decline while expenses rise. Globe Street See Also: As employers eagerly await the Covid-19 vaccines that promise to return staff to offices after months of working from home, new...

December 10th – Downdraft

What I’m Reading Downdraft: The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 75.4 percent of apartment households made a full or partial rent payment by December 6. While that is a whopping 780 basis point drop from 2019, it should be noted that December 5th and 6th both fell...

December 8th – Spin Cycle

One Big Thing I’ve been hearing a lot of chatter about the future of cities of late, especially those of the large gateway variety that boomed in the years following the Great Recession. The latest example is a Globe Street piece last week that excerpted a CBRE podcast about the future of...

December 4th – Strings Attached

What I’m Reading Strings Attached: CMBS borrowers that were granted initial forbearance in Q2 2020 are requesting another round of debt relief from servicers. However, even if granted this relief is likely to come with more stringent parameters such as additional equity contributions and personal recourse. Those who refuse or don’t...

December 2nd – The End is in Sight

What I’m Reading The End is in Sight: The Federal Reserve has told banks that they should stop writing contracts using LIBOR by the end of 2021, after which the rate no longer will be published. The current plan is that LIBOR will be fully phased out by June 30, 2023. ...

December 1st – Bargain Bin

What I’m Reading Bargain Bin: Cross border transactions are way down this year. However, the US commercial real estate market is starting to look very cheap to foreign investors, who find their currency hedging costs – driven by interest rate differentials between two currencies – aligning nicely with the direction of...

November 30th – Steady and Slow

What I’m Reading Slow and Steady: While the CMBS issuance volume has been consistently inching upward, 2020 issuance will close at roughly half of what was predicted a year ago, according to Kroll Bond Rating Agency. Kroll estimates this year’s total CMBS issuance will be $55 million while $95 billion was...