What I'm Reading Storm Clouds: The apartment sector has been a bright spot during COVID-19 but that is starting to change. Enhanced eviction protection, lower rent collections and unprecedented declines in asking rent in some urban markets are taking their toll on apartment owners. During the pandemic, the share of...

January 20th – Coming Into Focus

What I'm Reading Coming Into Focus: With COVID-19's resurgence, the early days of the Biden Administration will likely have a heavy focus on health and economic stabilization with an emphasis on infrastructure as well. As a result, it is less likely that proposals to narrow or eliminate 1031 exchanges will...

January 14th – Fire Sale?

What I'm Reading Sale of the Century? Some publicly traded REITs are taking advantage of their shares trading at a discount to net asset value and buying their own shares. The private market premium is pervasive and has sparked debate over whether REITs are undervalued, private markets are overvalued or somewhere...

January 11th – Wait and See

What I’m Reading Wait and See: NNN lease investors had assumed that Republicans would win the Georgia Senate special election and the 1031 exchange would be safe. Now that the Democratic party candidates have prevailed, those investors are anxiously awaiting President Elect Biden’s first 100 day agenda to see if the...

December 14th – Unlocked

What I’m Reading Unlocked: Increased adoption of remote work has enabled high earners to move to lower tax states like never before. At some point high tax cities and states are going to have to acknowledge that the conditions that allowed them to increase rates – namely the requirement of proximity...

December 9th – Balancing Act

One Big Thing California’s eviction moratorium is scheduled to expire in early February. A new assembly bill is seeking to extend it through the end of 2021. Concurrently another assembly bill is attempting to establish a framework for dispersing rental relief. (h/t Steve Sims) Connect Media Two comments here: While I’m...

December 1st – Bargain Bin

What I’m Reading Bargain Bin: Cross border transactions are way down this year. However, the US commercial real estate market is starting to look very cheap to foreign investors, who find their currency hedging costs – driven by interest rate differentials between two currencies – aligning nicely with the direction of...

November 25th – Locked Down

What I’m Reading Locked Down: In a move that should come as no surprise, President Elect Joe Biden and his team are leaning towards extending the CDC eviction moratorium that is set to expire December 31st. Ultimately, this program is just a band aid that forces landlords to shoulder the burden...

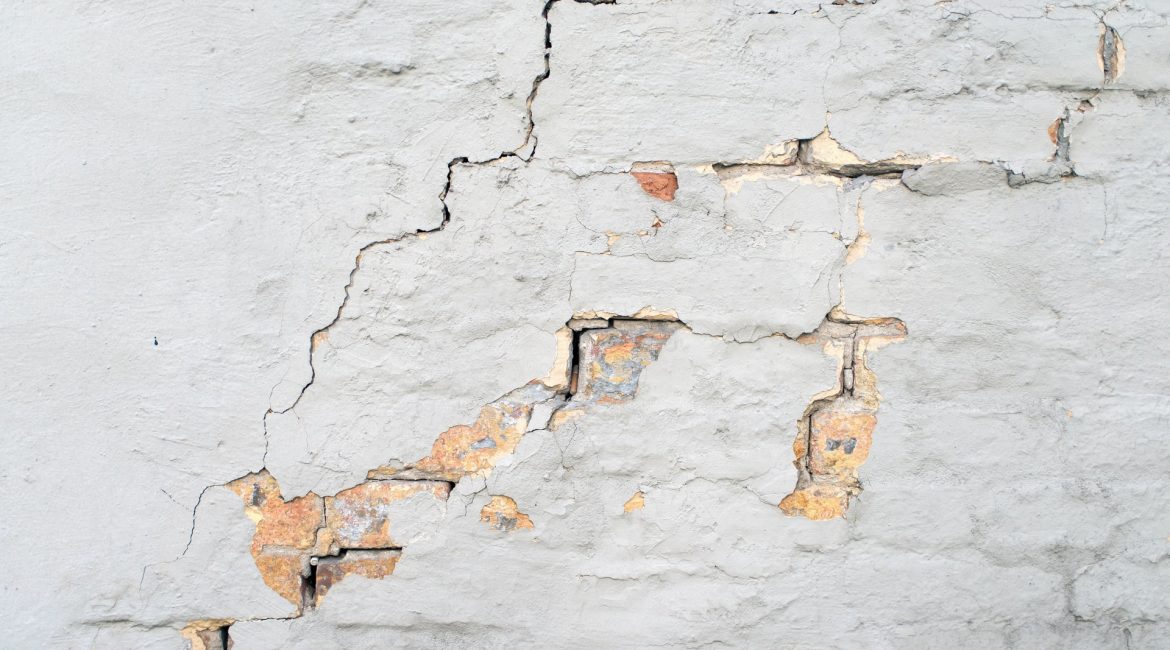

November 24th – Cracks in the Armor

What I’m Reading Cracks in the Armor: Chuck E Cheese (CEC Entertainment) was able to successfully use a Force Majeure clause to lower its rent in a bankruptcy case. This provided evidence that bankruptcy courts may be willing to grant debtors extraordinary relief in light of the ongoing pandemic, but...

November 20th – Swept Under the Rug

What I’m Reading Swept Under the Rug: October marked the fourth straight month that the overall lodging delinquency rate has fallen, according to Trepp. Unfortunately, this isn’t due to improved property performance but rather granted forbearance that is allowing loans to “current” status. Globe Street See Also: A new survey of American Hotel &...