First, Some Corporate News: RanchHarbor closed on our second deal since launching. This one is a sale-leaseback industrial portfolio in San Diego that was purchased in a joint venture with Stos Partners. Really excited to get another one in the books that will provide a solid yield for our investors. Feel free to reach out to me directly if you are interested in learning more. IREI

What I’m Reading

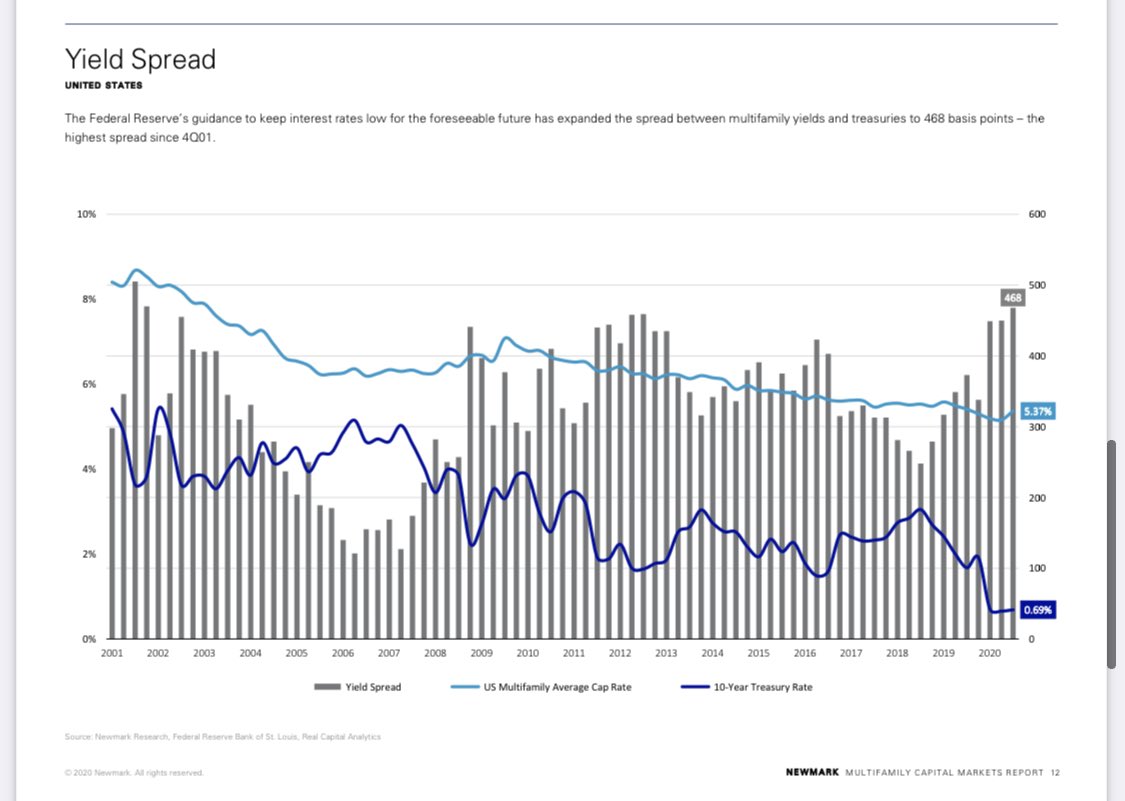

Back In Line: Mortgage rates have returned back to their historical spread over the 10-year treasury. I have been fairly vocal this year that rates could fall further thanks to the elevated spread over the 10-year after the March panic. That is no longer the case. It seems that there isn’t much room for rates to fall currently unless we see another major drop in the 10-year yield. This seems unlikely given the vaccine news but if this year has taught us anything its that you just never know. Calculated Risk

Jingle Mail: Simon Property Group, the largest U.S. shopping center operator is giving two properties back to their lenders and will stop injecting capital into two more. The total outstanding mortgage debt on these properties is over $400MM. Expect to see more of this as retail (and hospitality) landlords come to grips with the fact that their properties are worth less than their outstanding debt. MarketWatch

Warp Speed: Digital Commerce was increasing long before the pandemic hit but it has accelerated the trend substantially. As a result, more consumers are trying new ways to get health care, buy vehicles, eat and work out than ever before. Wall Street Journal

Staying Put (For Now): Cushman & Wakefield took an inside look at business migration patterns, and so far, they are sticking to major markets and not following residents to the suburbs. Globe Street

Building Out: More than 373 megawatts of new wholesale data center construction is underway across major markets in the United States, according to a newly-published 2021 market outlook from CBRE. The real estate firm forecasts that total data center inventory will grow by 13.8% in 2021. CBRE

Chart of the Day

Source: Newmark

WTF

What Goes Down….: A man wanted for his role in an alleged $35 million Ponzi scheme was arrested Monday after evading FBI agents by swimming into California’s largest reservoir using an underwater “sea scooter,” before resurfacing and ultimately getting arrested. CBS

It’s Nice: A mysterious Viagra-like chemical leak left an entire village horny and hallucinating after seeping into water supply because Kazakhstan. And here you thought that Borat was fake. News Daily

Basis Points – A candid look at the economy, real estate, and other things sometimes related.

Visit us at RanchHarbor.com