What I'm Reading Spooked: With $300 billion in outstanding debt, troubled mega-developer Evergrande has been dubbed the "Chinese Lehman." After expanding for years, the company has been scrambling to pay suppliers, and warned investors twice in as many weeks that it could default on its debts. If this were to occur,...

September 21st – Logjam

What I'm Reading Logjam: The Los Angeles / Long Beach port logjam has enough containers to cross half of the US if laid end-to-end. Amazingly, the problem is getting worse. The average wait is currently 8.7 days compared with 6.2 in mid-August, according to L.A. gCaptain Respite: The producer price...

September 20th – Flipped

What I'm Reading Down for the Count: Leisure travel has experienced a strong bounce back year in 2021. However, business travel is still struggling. Corporate, group, government, and other commercial travel – are expected to be down by $59 billion in 2021 from 2019, according to a report from the...

September 17th – Locals Only

What I'm Reading Locals Only: The greater Phoenix area has record demand for new rental housing. However, cities are pushing back, leading to higher prices. AZ Big Media Looks like California has exported its shitty land use politics as more Golden State residents move to the desert. Cooling: August's CPI...

September 16th – Under Pressure

What I'm Reading Under Pressure: CBRE's latest cap rate survey showed compression almost across the board with the most desirable product types - multifamily and industrial - in the best locations trading at average cap rates that start with a 3. CBRE I suppose that at a certain point, the...

September 15th – Goldmine

Traveling for a conference this week and a little short on time so we will just be focusing on some interesting home equity charts today from Black Knight’s latest Mortgage Monitor Report. Chart of the Day US homeowners are sitting on a goldmine when it comes to tappable home equity...

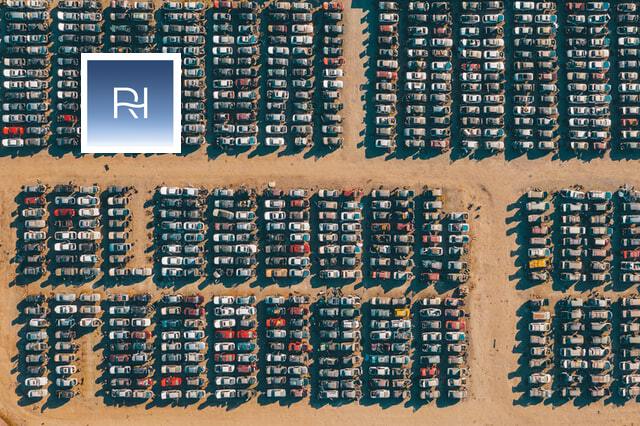

September 14th – Chop Shop

What I'm Reading Chop Shop: Single family rental platforms are increasingly allowing investors to buy shares in homes for as little as $10. The Real Deal IMO, this trend is a governance nightmare waiting to happen. Small investors would be far better served buying shares in Invitation Homes or American...

September 10th – Putting This to Bed

What I'm Reading Putting This to Bed: In total, 1 million forbearance plans will expire between now and the end of 2021. There is a vocal contingent that has been predicting a wave of foreclosures for months. However, I am virtually certain that this won't happen as almost all of...

September 9th – Back to School

What I'm Reading Back to School: COVID caused slowing of new supply in the student housing market, helping to stabilize rents. Now that class is back in session, some of the world's largest property investors are pumping billions of dollars into buying and developing off-campus housing. (h/t Mike Deermount) Wall...

September 8th – 800 LB Gorilla

What I'm Reading 800 LB Gorilla: Amazon is on pace to absorb nearly 120 million square feet of commercial space this year and accounts for eight of the ten largest industrial projects underway in the United States. The ecommerce giant is having a massive impact on everything from pricing and...