What I’m Reading The End is in Sight: The Federal Reserve has told banks that they should stop writing contracts using LIBOR by the end of 2021, after which the rate no longer will be published. The current plan is that LIBOR will be fully phased out by June 30, 2023. ...

December 1st – Bargain Bin

What I’m Reading Bargain Bin: Cross border transactions are way down this year. However, the US commercial real estate market is starting to look very cheap to foreign investors, who find their currency hedging costs – driven by interest rate differentials between two currencies – aligning nicely with the direction of...

November 25th – Locked Down

What I’m Reading Locked Down: In a move that should come as no surprise, President Elect Joe Biden and his team are leaning towards extending the CDC eviction moratorium that is set to expire December 31st. Ultimately, this program is just a band aid that forces landlords to shoulder the burden...

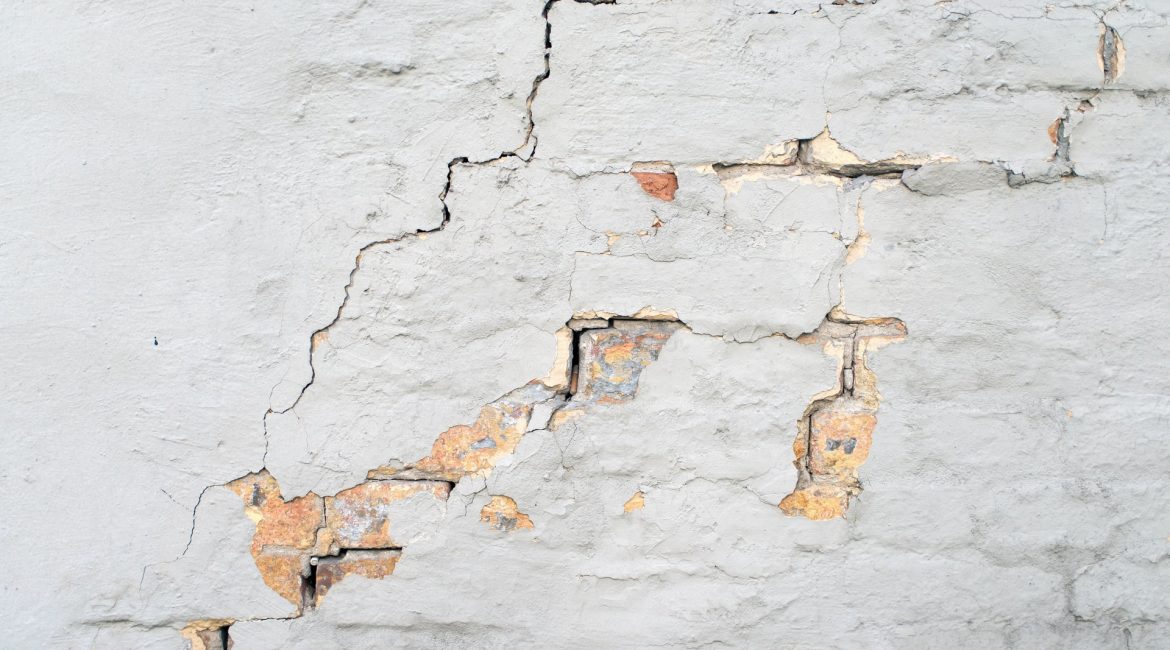

November 24th – Cracks in the Armor

What I’m Reading Cracks in the Armor: Chuck E Cheese (CEC Entertainment) was able to successfully use a Force Majeure clause to lower its rent in a bankruptcy case. This provided evidence that bankruptcy courts may be willing to grant debtors extraordinary relief in light of the ongoing pandemic, but...

November 18th – Back in Line

First, Some Corporate News: RanchHarbor closed on our second deal since launching. This one is a sale-leaseback industrial portfolio in San Diego that was purchased in a joint venture with Stos Partners. Really excited to get another one in the books that will provide a solid yield for our investors. ...

November 17th – What Lies Ahead

One Big Thing There has been a lot of COVID news to digest in recent days so I thought it would be helpful to put together a quick summary of what is going on. On the infection side, things are undeniably bad and getting worse. We have now seen over 11...

November 16th – Such a Tangled Web

What I’m Reading Tangled Web: As malls continue to struggle, their financing structures – which have only grown more complex over time – are making restructuring particularly challenging. This is perhaps the biggest downside of using CMBS, especially when layered with other forms of financing. When you borrow from a bank...

November 12th – Canary in the Coal Mine

What I’m Reading Canary in the Coalmine: Office REITs have underperformed dramatically this year but their beat-down shares may be a good under-the-radar way to play the vaccine trade. However, upside may be capped by behavioral headwinds. P.S. Shouldn’t need to say it but this is IN NO WAY investment advice. MSN...

November 9th – Thou Dost Protest Too Much

One Big Thing Its no secret that office landlords – especially those in expensive coastal markets – are struggling. Vornado Realty Trust (VNO) is one of the worst positioned for the post-pandemic world with the vast majority of its holdings in NYC. Vornado’s recent earnings sucked – and missed already-low...

November 4th – Time Warp

One Big Thing: I wrote a year in review (or at least the first 10 months) piece that the Mann Report is running as a cover feature. Here’s an excerpt. 2020 was the year when time both accelerated and stood still. From a purely human perspective, crises and trauma are known...