We are entering the ‘decision’ phase of this real estate cycle.

The quote, “It ain’t no fun when the rabbit’s got the gun,” describes a situation where you no longer have the upper hand. Think Elmer Fudd and Bugs Bunny. And think of real estate investors as Elmer Fudd and the Fed as Bugs Bunny. Bugs Bunny is now hunting down Elmer Fudd – That is how we feel about the Fed and the current real estate markets.

We have been observing our internal evolution of emotions throughout the cycle thus far. March 2022 was the start of the cycle downshift. At that time, we were in due diligence on a multi-tenant, industrial property that we closed in May of 2022 (and thankfully is performing). The Fed had just commenced its rate hike regime. During our DD period, we believed we had secured a 5-year, fixed-rate loan around 4% with a life insurance company (Lifeco). All seemed fine. Halfway through its diligence period, the Lifeco pulled its loan commitment and we quickly pivoted to a 3-year bridge loan with a debt fund. Terms were SOFR + 335. We acquired a 2% rate cap for the duration of the loan which matures in 2025. Shout out to the mantra, “Stay alive to 25!”

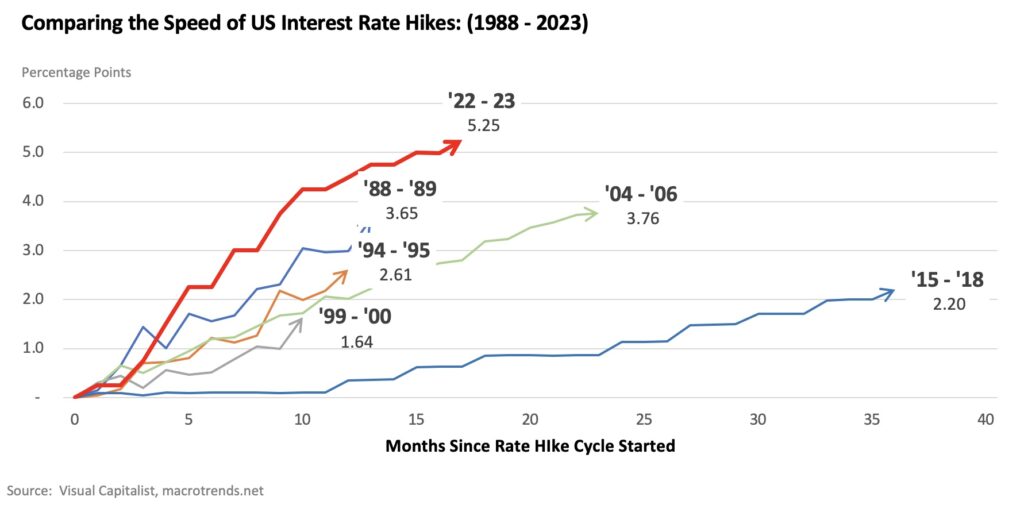

We begin our Fall 2023 investment outlook with this anecdote because it was at that time that we knew the game was changing. In March 2022, lenders were still aggressive and when that Lifeco pulled its commitment to an infill, light industrial deal in LA County, we knew the landscape was changing. Fast forward to today and the Fed’s rate hike onslaught has resulted in 11 rate increases since March 2022 and the fastest rate increase in over 40 years.

Moreso than ever, we fully appreciate how valuable inexpensive rate caps were back in early 2022, we fully appreciate interest reserves, and we fully appreciate our investors’ anxiety and concerns about their real estate investments. As for the chart below, all we can say is …. Speed kills!

Current Investment Environment

As an investor, there is a natural tension between managing your current portfolio and looking for new opportunities. Both require discipline and time. Given the uncertainty and volatility in today’s capital markets, available liquidity has diminished significantly and in turn transaction volume has fallen as real estate fundamentals are being challenged.

This is a key theme in today’s real estate investment environment – the tension between taking care of what you own and determining a fair value at which to buy new assets. The latter is much more challenging. It is very easy to take the ‘pencils down’ approach and wait for the storm to run out of rain.

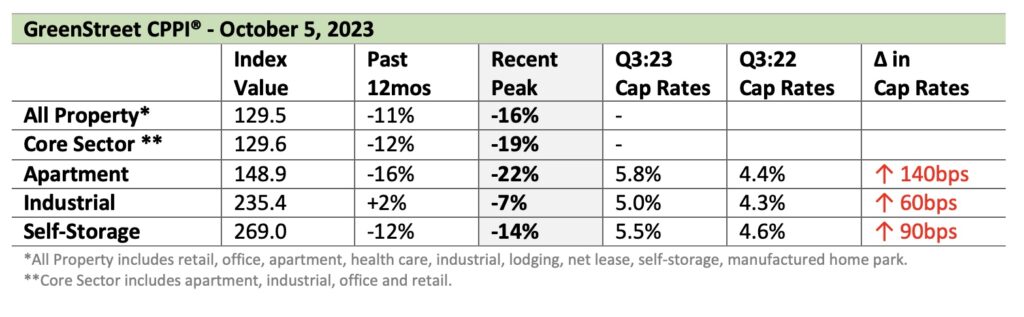

Below is GreenStreet’s Commercial Property Price Index (CPPI®) which tracks valuations on a macro level for institutional quality real estate. Valuations across all asset classes continue to decline and cap rate expansion has been pronounced in a short amount of time.

As investors, the critical challenge continues to be ascribing an appropriate exit cap in this environment along with a myriad of other assumptions (including operating expenses, rent growth, or further rent decline, vacancy, cost of capital, etc). There is no shortage of uncertainty in underwriting assumptions in this environment. That said, the best way to mitigate this risk is to identify medium to long-term macro trends and structure deals to take advantage of them.

RanchHarbor Portfolio

Our priority as asset managers is safeguarding investor capital and managing our current portfolio of assets. We are invested in six states (CA, AZ, ID, NM, TX, FL) with holdings in multifamily, industrial and a large RV & Boat / IOS facility in Florida with a total AUM in excess of $150 million. Of note, we are experiencing material increases in insurance across the board. The weekly calls with property managers and operating partners are very focused on managing operating expenses and occupancy. To be sure, it is more art than science.

As a general observation across our portfolio, there is downward pressure on fundamentals. Specifically in multifamily, the combination of so much rent growth pulled forward in 2021 and 2022 and record levels of new supply means the prospect of any significant rent growth in the next few years will be limited. We fully recognize all real estate is local, however, fundamentals will continue to be challenged in the near-term.

Theme of New Investment Opportunities

In today’s environment, the clear and present catalyst to new investment opportunities is the wave of loan maturities coming across all real estate sectors in the next 12 – 18 months. It appears the ‘higher for longer’ theme as it pertains to interest rates will continue. Both lenders and borrowers will be facing difficult strategic decisions in the near term. Here at RanchHarbor, the profile of investment opportunities coming across our desk is evolving. We continue to view loan assumption opportunities and deals where we can acquire all-cash as optimal in this environment, but we are seeing an uptick in ‘motivated or distressed’ sellers. We know this will not just continue but accelerate. Given the substantial cost to refinance in this environment, there is no question that many sellers will be facing the proverbial ‘checkmate.’

While challenging fundamentals, higher interest rates, and elevated levels of new supply will produce short-term headwinds, we fully expect the wind to shift in favor of landlords. New supply is already on a strong downward trajectory as higher interest rates make development economics no longer pencil. Reduced supply will improve fundamentals once the current supply pipeline is absorbed. We also firmly believe that inflation is largely behind us based on the fact that shelter cost has been the primary driver in recent inflation reports but is a notoriously lagging data point. In real time, we are seeing rents flatten or decrease in most markets. This will ultimately show up in the data and we believe this will lead to a more accommodative Fed and improve capital flows into commercial real estate.

As investors, we want to position ourselves for this shift by focusing on properties with strong medium to long-term growth prospects and conservative capital structures that provide ample time to allow fundamentals to improve, the flow of available debt to increase, and equity to come off the sidelines. The best opportunities typically occur when markets are dislocated, and sellers far outnumber buyers. That day is on the horizon.

Looking Ahead

We share the following excerpt from the book, The Psychology of Money, by Morgan Housel – “The most important driver of anything tied to money or investments is the stories people tell themselves to rationalize their decisions and actions.” What stories are you telling yourself about potential investments or your current portfolio in this environment? There are days we tell ourselves that perhaps we shouldn’t be coming into the office to avoid doing a deal and regret it later! We often discuss how our best 2-3 deals have been deals we ended up not doing. Joking aside, risk aversion is on everyone’s mind.

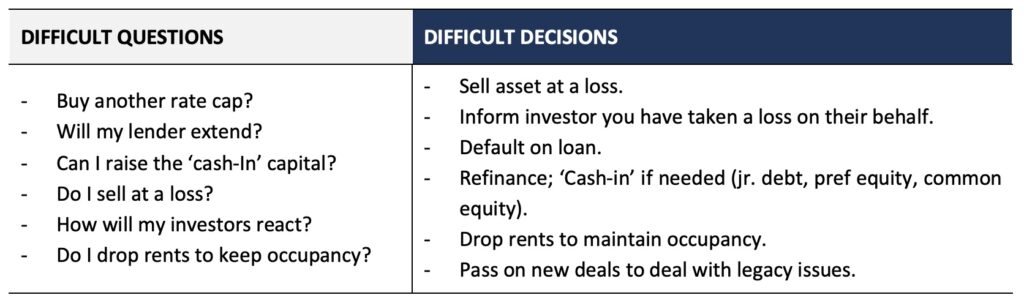

Given the current structure of interest rates and pending loan maturities occurring in the next 12 months, borrowers/asset owners will be required to answer difficult questions and make difficult decisions:

These are serious dilemmas. Hence, the title of our Fall Investment Outlook – ‘It ain’t no fun when the rabbit’s got the gun.’ Ironically, according to the Chinese Zodiac, 2023 is the Year of the Rabbit. Now we know why.

There will be decisions made in the coming months that will create significant investment opportunities.

We close our Investment Outlook with the old saying about history. “Things that have never happened before happen all the time.” Said differently, history is mostly the study of surprising events. As investors, we should reflect on this given we just experienced the fastest rate increase in the past 40 years.

The world is difficult to anticipate.

All the best to you and yours as we close out 2023.

Sincerely

The RanchHarbor Investment Team

ABOUT RANCHHARBOR

RanchHarbor is a real estate investment firm based in Newport Beach, Calif., focused on investing in small-cap, value-add opportunities in the multifamily, industrial and storage sectors. RanchHarbor provides joint venture equity, general partner co-invest equity and invests directly in real estate. Target equity investments range between $2 million and $10 million in select U.S. markets. The firm also provides sophisticated asset management services to its institutional and private investors and operating partners. Since its founding in 2012, RanchHarbor (formerly Isles Ranch Partners) has closed on 50 investments, managing over $650 million of equity capital. In 2020, the firm shifted its focus to investing in value-add real estate. For more information, visit ranchharbor.com. Follow the company on LinkedIn.