What I’m Reading Blurred Lines: States are facing off in a high-stakes legal battle over who is entitled to income taxes on remote workers when one is employed by a company in one state but resides in another. The results of this high-stakes legal battle will have a profound impact on...

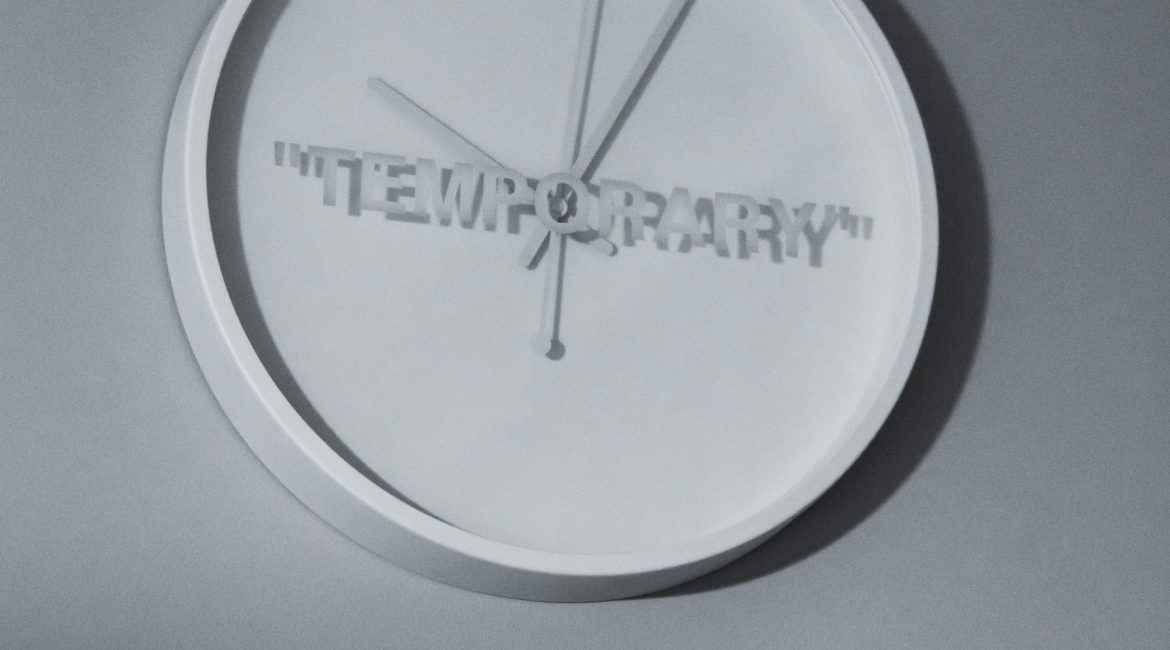

December 21st – Temporary Move?

What I’m Reading Temporary Solution: The number of renters seeking short term (less than 6 month) lease arrangements when moving to new cities is way up this year. This suggests that the move away from urban markets may be more temporary than thought. Apartment List Sweet Spot: Pent up demand, healthy...

December 14th – Unlocked

What I’m Reading Unlocked: Increased adoption of remote work has enabled high earners to move to lower tax states like never before. At some point high tax cities and states are going to have to acknowledge that the conditions that allowed them to increase rates – namely the requirement of proximity...

December 10th – Downdraft

What I’m Reading Downdraft: The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 75.4 percent of apartment households made a full or partial rent payment by December 6. While that is a whopping 780 basis point drop from 2019, it should be noted that December 5th and 6th both fell...

December 7th – Behind the Curve

What I’m Reading Behind the Curve: As expected, eCommerce orders surged to previously unseen levels this Black Friday and Cyber Monday. It got to the point that UPS put limits on pickups at several large retailers in an effort to not overwhelm their systems, despite knowing that this was coming. Wall Street...

December 2nd – The End is in Sight

What I’m Reading The End is in Sight: The Federal Reserve has told banks that they should stop writing contracts using LIBOR by the end of 2021, after which the rate no longer will be published. The current plan is that LIBOR will be fully phased out by June 30, 2023. ...

December 1st – Bargain Bin

What I’m Reading Bargain Bin: Cross border transactions are way down this year. However, the US commercial real estate market is starting to look very cheap to foreign investors, who find their currency hedging costs – driven by interest rate differentials between two currencies – aligning nicely with the direction of...

November 23rd – Its Going Down

What I’m Reading Its Going Down: The MBA is out with its 2021 market outlook for housing. The big news here is that they are projecting a major slowdown for the mortgage lending industry with refinances falling a whopping $1 trillion – from $1.97 trillion to $971 billion – thanks to...

November 16th – Such a Tangled Web

What I’m Reading Tangled Web: As malls continue to struggle, their financing structures – which have only grown more complex over time – are making restructuring particularly challenging. This is perhaps the biggest downside of using CMBS, especially when layered with other forms of financing. When you borrow from a bank...

November 10th – Shot in the Arm

One Big Thing Like me, most of you probably woke up yesterday morning to the Pfizer COVID-19 vaccine news from the AP: Pfizer Inc. said Monday that its COVID-19 vaccine may be a remarkable 90% effective, based on early and incomplete test results that nevertheless brought a big burst of optimism...