What I'm Reading Parched: The federal government has declared a first-ever shortage on the Colorado River, announcing mandatory water cutbacks next year for Arizona, Nevada and Mexico. The river provides water to 40 million people and California could be impacted by 2024. This is going to have massive ramifications on...

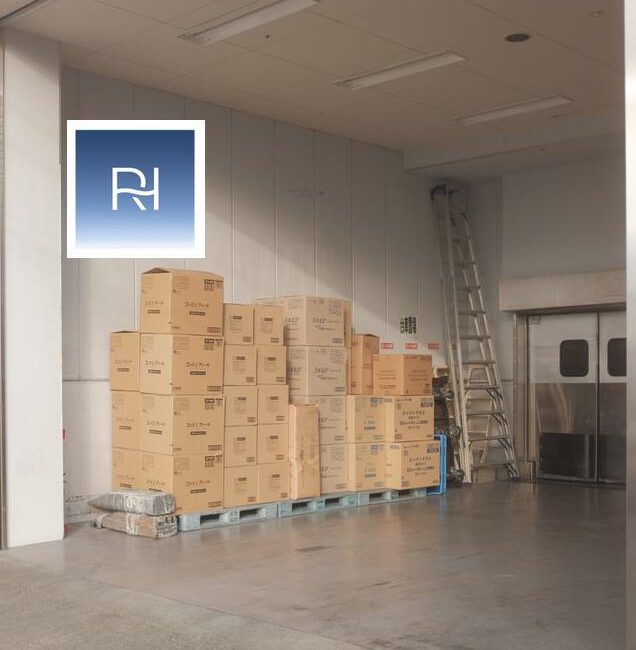

August 3rd – Packing Heat

What I'm Reading Packing Heat: The packaging industry is growing as soaring ecommerce adoption has led to higher demand for boxes. As a result, demand is increasing for industrial space used to produce and distribute packaging. Fast Company Waiting Game: Home builders are intentionally restricting the sale of new homes...

July 15th – In N Out

What I'm Reading In N Out: Starwood is throwing in the towel on the mall business, selling 22 of the 30 malls that it owned before COVID and taking a loss in order to get out from underneath approximately $2 billion in CMBS debt. Essentially, Starwood decided that they will...

July 1st – Hiding in Plain Sight

What I'm Reading Hiding in Plain Sight: It's well known that US infrastructure from roads, to bridges, to tunnels is falling apart. The tragic Florida condo collapse this week highlights another type of private infrastructure disaster that may be much more widespread than we currently think. Justin Gillis highlighted the...

June 15th – Round Trip

What I'm Reading Out of Balance: A recent study by LendingTree found that median housing costs were lower for renters than for homeowners with a mortgage in all 50 of the largest US metro areas. Lending Tree Backed Up: The primary driver of the inflationary spike that we are currently...

May 28th – Risky Business

One Big Thing Real Assets Adviser / IREI published an editorial that I wrote about some of the often-unseen risks in crowdfunded real estate transactions as part of their June edition: Warren Buffet famously said, “Only when the tide goes out do you discover who’s been swimming naked.” In recent...

May 27th – New High

What I'm Reading New High: The nationwide price to rent ratio has hit its highest level since at least 1975, taking out the 2006 peak. While I am still not sold on the idea that we are in a bubble, valuations are clearly very rich and we are clearly well...

May 11th – Running of the Bulls

What I'm Reading Glass Half Full: The results DLA Piper’s latest State of the Market Survey revealed no shortage of bullish sentiment about commercial real estate with 74% expressing optimism about the market in 2021 versus just 24% a year prior. Respondents were especially bullish on markets like Austin and...

May 6th – More Than Meets the Eye

What I'm Reading Evolution: A new breed of flexible work landlords is converting unused suburban retail locations to office space, potentially transforming downtowns in the process. Wall Street Journal Bottleneck: The Biden administration is racing to end a bottleneck that has prevented state and local governments from distributing nearly $50...

April 21st – Wait and See

What I'm Reading Wait and See: The office market is in for a long period of adjustment as tenants take a non-committal, wait and see approach to what the future will hold while scaling back gradually on their footprint. AVC Anti Establishment: Americans have unprecedented access to marijuana as numerous...