What I’m Reading Behind the Curve: As expected, eCommerce orders surged to previously unseen levels this Black Friday and Cyber Monday. It got to the point that UPS put limits on pickups at several large retailers in an effort to not overwhelm their systems, despite knowing that this was coming. Wall Street...

December 4th – Strings Attached

What I’m Reading Strings Attached: CMBS borrowers that were granted initial forbearance in Q2 2020 are requesting another round of debt relief from servicers. However, even if granted this relief is likely to come with more stringent parameters such as additional equity contributions and personal recourse. Those who refuse or don’t...

December 3rd – Emptied Out

What I’m Reading Emptied Out: In 2011, US department stores employed 1.2 million employees across 8,600 stores, according to estimates from the research firm IBISWorld. But in 2020, there are now fewer than 700,000 employees in the sector, working across just over 6,000 locations. Vox Comeback Kid: The fact that AirBnb is about...

December 2nd – The End is in Sight

What I’m Reading The End is in Sight: The Federal Reserve has told banks that they should stop writing contracts using LIBOR by the end of 2021, after which the rate no longer will be published. The current plan is that LIBOR will be fully phased out by June 30, 2023. ...

November 30th – Steady and Slow

What I’m Reading Slow and Steady: While the CMBS issuance volume has been consistently inching upward, 2020 issuance will close at roughly half of what was predicted a year ago, according to Kroll Bond Rating Agency. Kroll estimates this year’s total CMBS issuance will be $55 million while $95 billion was...

November 25th – Locked Down

What I’m Reading Locked Down: In a move that should come as no surprise, President Elect Joe Biden and his team are leaning towards extending the CDC eviction moratorium that is set to expire December 31st. Ultimately, this program is just a band aid that forces landlords to shoulder the burden...

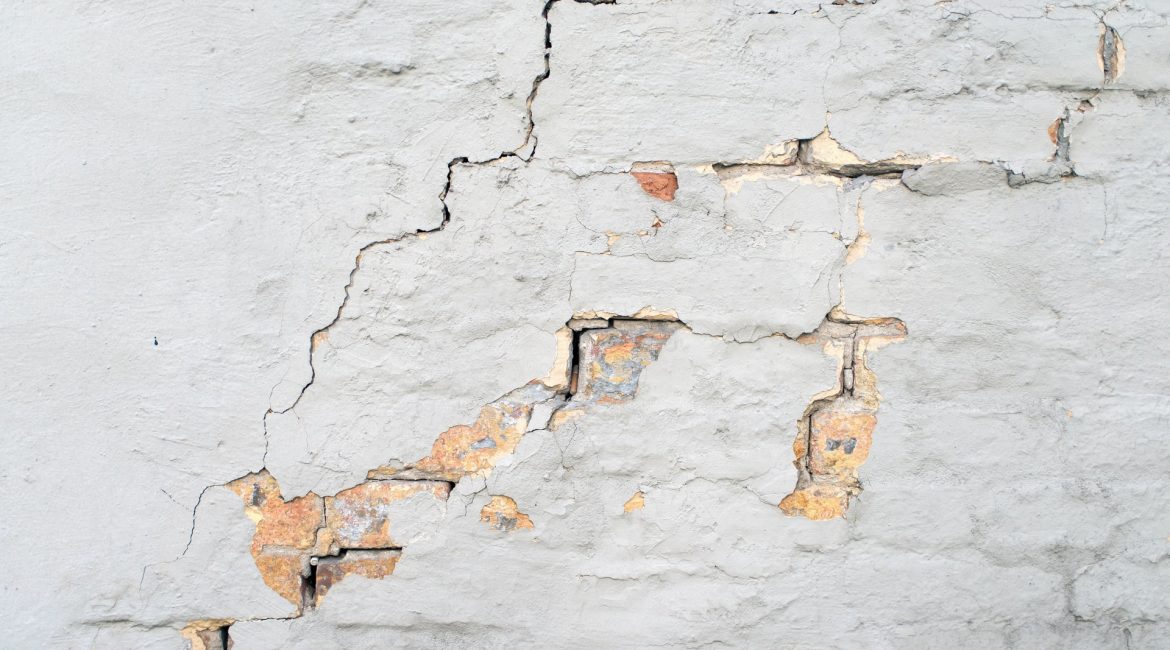

November 24th – Cracks in the Armor

What I’m Reading Cracks in the Armor: Chuck E Cheese (CEC Entertainment) was able to successfully use a Force Majeure clause to lower its rent in a bankruptcy case. This provided evidence that bankruptcy courts may be willing to grant debtors extraordinary relief in light of the ongoing pandemic, but...

November 20th – Swept Under the Rug

What I’m Reading Swept Under the Rug: October marked the fourth straight month that the overall lodging delinquency rate has fallen, according to Trepp. Unfortunately, this isn’t due to improved property performance but rather granted forbearance that is allowing loans to “current” status. Globe Street See Also: A new survey of American Hotel &...

November 19th – Ringing the Bell

One Big Thing The Fed is now in a tricky spot when it comes to their massive mortgage bond buying program (emphasis mine): All of this serves to squeeze mortgage-bond investors in higher-rate securities. Most of them bought the debt at a premium, and the constant reduction in lending rates leaves...

November 18th – Back in Line

First, Some Corporate News: RanchHarbor closed on our second deal since launching. This one is a sale-leaseback industrial portfolio in San Diego that was purchased in a joint venture with Stos Partners. Really excited to get another one in the books that will provide a solid yield for our investors. ...