What I’m Reading The End is in Sight: The Federal Reserve has told banks that they should stop writing contracts using LIBOR by the end of 2021, after which the rate no longer will be published. The current plan is that LIBOR will be fully phased out by June 30, 2023. ...

December 1st – Bargain Bin

What I’m Reading Bargain Bin: Cross border transactions are way down this year. However, the US commercial real estate market is starting to look very cheap to foreign investors, who find their currency hedging costs – driven by interest rate differentials between two currencies – aligning nicely with the direction of...

November 30th – Steady and Slow

What I’m Reading Slow and Steady: While the CMBS issuance volume has been consistently inching upward, 2020 issuance will close at roughly half of what was predicted a year ago, according to Kroll Bond Rating Agency. Kroll estimates this year’s total CMBS issuance will be $55 million while $95 billion was...

November 25th – Locked Down

What I’m Reading Locked Down: In a move that should come as no surprise, President Elect Joe Biden and his team are leaning towards extending the CDC eviction moratorium that is set to expire December 31st. Ultimately, this program is just a band aid that forces landlords to shoulder the burden...

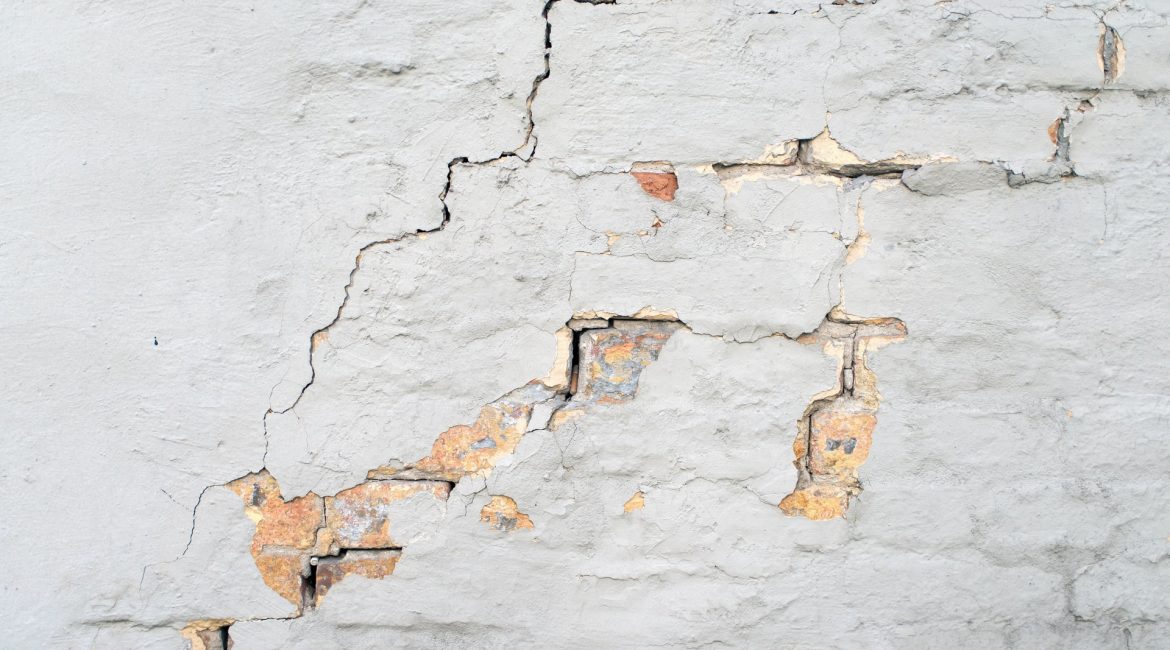

November 24th – Cracks in the Armor

What I’m Reading Cracks in the Armor: Chuck E Cheese (CEC Entertainment) was able to successfully use a Force Majeure clause to lower its rent in a bankruptcy case. This provided evidence that bankruptcy courts may be willing to grant debtors extraordinary relief in light of the ongoing pandemic, but...

November 23rd – Its Going Down

What I’m Reading Its Going Down: The MBA is out with its 2021 market outlook for housing. The big news here is that they are projecting a major slowdown for the mortgage lending industry with refinances falling a whopping $1 trillion – from $1.97 trillion to $971 billion – thanks to...

November 20th – Swept Under the Rug

What I’m Reading Swept Under the Rug: October marked the fourth straight month that the overall lodging delinquency rate has fallen, according to Trepp. Unfortunately, this isn’t due to improved property performance but rather granted forbearance that is allowing loans to “current” status. Globe Street See Also: A new survey of American Hotel &...

November 19th – Ringing the Bell

One Big Thing The Fed is now in a tricky spot when it comes to their massive mortgage bond buying program (emphasis mine): All of this serves to squeeze mortgage-bond investors in higher-rate securities. Most of them bought the debt at a premium, and the constant reduction in lending rates leaves...

November 11th – Changing of the Guard

What I’m Reading Changing of the Guard: Office, hospitality and retail, three of real estate’s most institutionalized sectors, are facing long-term structural headwinds. At the same time, formerly-niche sectors like cold storage, self-storage, medical office and data centers are getting more institutional attention thanks to their resiliency in the face of...

November 10th – Shot in the Arm

One Big Thing Like me, most of you probably woke up yesterday morning to the Pfizer COVID-19 vaccine news from the AP: Pfizer Inc. said Monday that its COVID-19 vaccine may be a remarkable 90% effective, based on early and incomplete test results that nevertheless brought a big burst of optimism...